USD/JPY Spiked After Bank of Japan Adopted Negative Interest Rates

USD/JPY Spiked After Bank of Japan Adopted Negative Interest Rates

Talking Points:

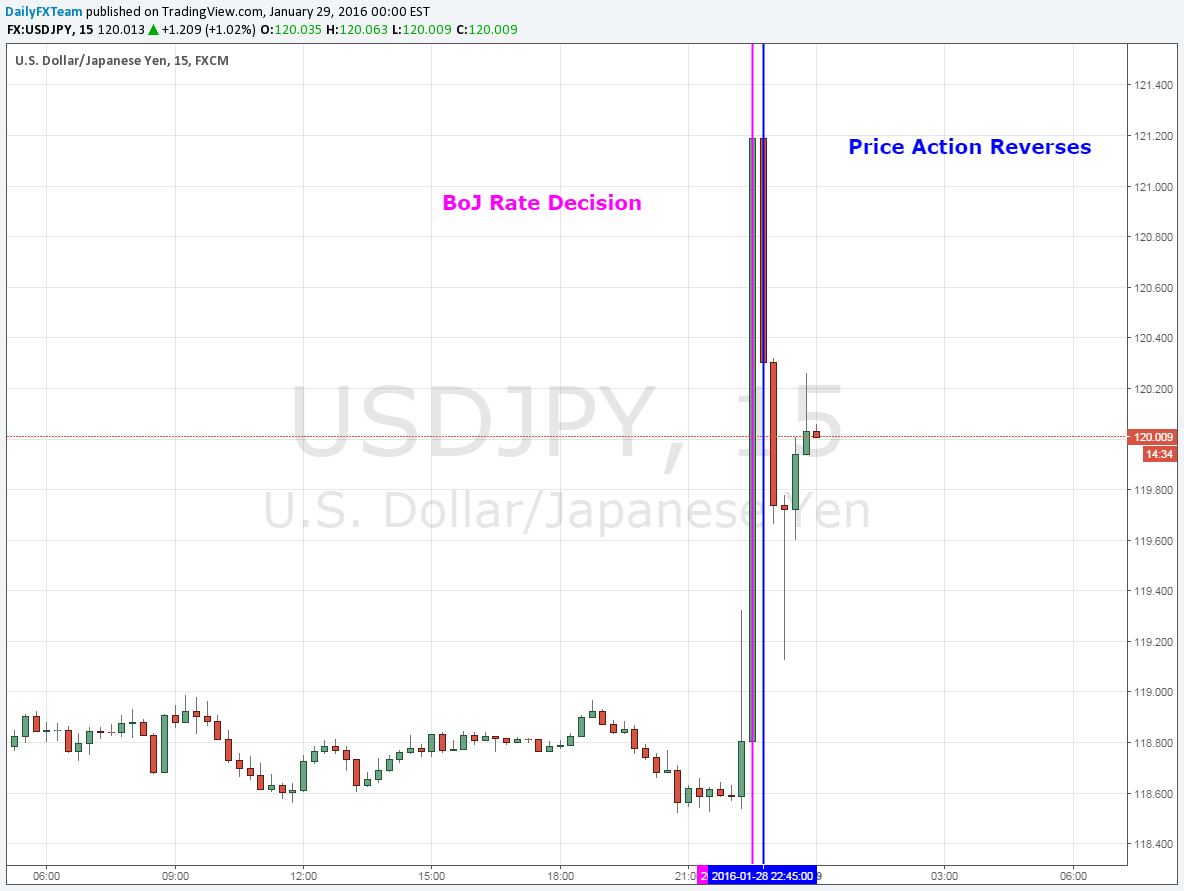

- Yen plummeted against US Dollar after the BoJ cut interest rates to -0.1%

- Bo J delayed the timing of 2% CPI target to first half of 2017 fiscal year

- Price action quickly reversed, hinting at markets’ lack of conviction in the policy vote

The Yen fell and then quickly rallied against the US Dollar after the Bank of Japan took several accommodative measures in its January policy vote. The central bank implemented the following actions:

- Adopted negative interest rates of 0.1 percent, to be applied from February 16th

- Delayed the timing for reaching the 2 percent inflation target to first half of 2017 fiscal year

- Created a three-tier system for current accounts; tiers include positive, zero and negative rates

These dovish policy changes weighed on the Yen in the beginning. Soon after, price action quickly reversed, hinting at traders’ lack of conviction in the Bank of Japan’s rate decision.

The BoJ’s commentary after the announcement noted that the central bank will cut interest rates further into negative territory if need be. It also expressed concern that the Japanese economy has exposure to international risk.

Although the Bank of Japan altered several of its policies, it chose to leave the annual rise in the monetary base unchanged at ¥80 trillion.