First, a review of last week’s forecast:

- as for the EUR/USD, the past week showed vividly that fundamental events can refute all forecasts of technical analysis. Thus the ECB decision on key interest rates stopped the falling trend on Thursday and brought the pair to month old figures;

- the GBP/USD managed to confirm the forecast before Thursday started, according to which the pair was supposed to fall to the level 1.4890. The pair reached this support in mid week after which, following the ECB decisions, it went up, returning to average numbers of the previous week;

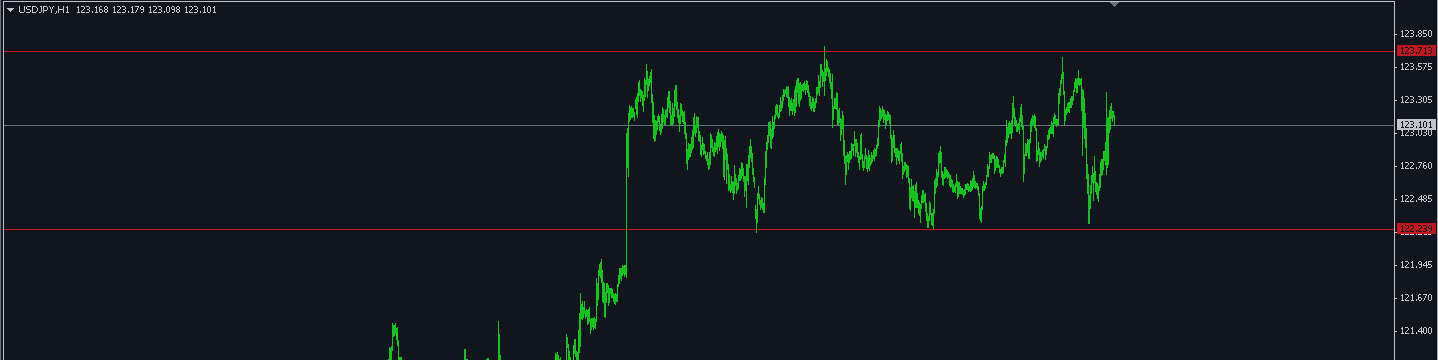

- with regard to the future of USD/JPY, the opinions diverged last week. Most experts insisted on a transition of the pair to the zone 123.00 ÷ 124.00, graphical analysis, on the opposite, foresaw its fall to the support of 121.50, and then return to the Pivot Point - 122.80. Indicators on D1 also voted for the continuation of the sideways trend. As a result the pair satisfied all the declarations: it went both to the height of 123.70 and to the depth of 122.30 and finally came back to the zone of average figures of the last 4 weeks confirming the forecast of continuation of sideways trend;

- if we talk about forecasts for USD/CHF, graphical analysis on D1 warned that it could easily go down to the level of 0.9850 during the week. It turned out that the pair just waited for a reason to fulfil this forecast. And such a reason appeared to be the ECD Mario Draghi, thanks to whose decisions the pair plunged down almost 400 points, then it came to senses and bounced to the key level 1.0000.

***

Forecast for the upcoming week.

Summing up the opinions of several dozen analysts from world leading banks and broker companies as well as forecasts based on various methods of technical and graphical analysis, the following can be suggested:

- regarding the future of the EUR/USD indicators, which is logical after the speech of Mr. Draghi, are in utter confusion: 85% of them vote for the growth on H4, only 58% on D1, and on W1 they make up only 16%. As for the opinion of analysts, the 70% of them believe that the pair will still continue its march to the north in an effort to reach the area 1.1000 ÷ 1.1100;

- but as for the GBP/USD, it is almost unanimously that experts, indicators on H4 and graphical analysis on the same time-frame predict the pair to grow to the level of 1.5200. The next resistance is at 1.5270. At the same time graphical analysis on H1 indicates that the pair can go down to the support zone of 1.5055 before starting growth;

- the future of the USD/JPY is not so much doubtful either. Both analysts and all the tools of technical and graphical analysis almost unanimously suggest that the pair will continue sideways movement in the same channel through which it started its sailing on November 6. The Pivot Point is at 122.95, support - at 122.20, resistance - at 123.75. Only one expert does not rule out that the pair will rise to a height of 125.00;

- the forecast is not so clear for the pair USD/CHF. And if the majority of experts supported by graphical analysis on H4 predict it to rise to the level of 1.1000, the indicators both on H4 and D1 are more inclined to see the pair go down. By the way, graphical analysis on D1 also believes that before taking off to the above height, the pair should first fall to the support zone of 0.9765.

Roman

Butko, NordFX & Sergey Ershov