Morgan Stanley estimated the most interesting possible trades by the direction for some pairs which they will trade in 2016.

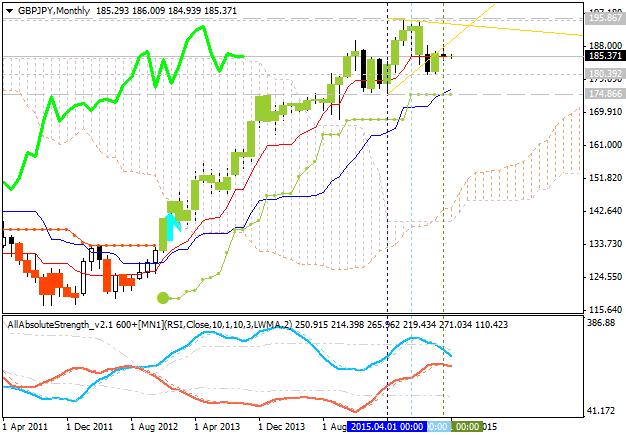

GBP/JPY. Short.

Monthly price is on bullish market condition with the ranging within 195.86 resistance and 174.86 support levels. Morgan Stanley evaluated this pair to be in short by direction for 2016 which means that 174.86 support level may be broken to below and the price will start the secondary correction within the primary bullish market condition.

| Resistance | Support |

|---|---|

| 195.86 | 180.39 |

| N/A | 174.86 |

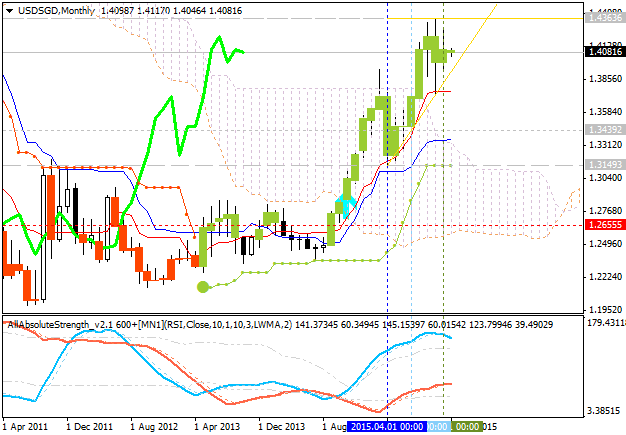

USD/SGD. Long.

Morgan Stanley stated that this pair is one of the most interesting for trading in 2016: the direction is long, and the level to start openning buy trades is 1.4363 resistance level.

| Resistance | Support |

|---|---|

| 1.4363 | 1.3439 |

| N/A | 1.3149 |

USD/PLN. Long.

The price for this pair is on bullish breakout which was started in September 2014, and this breakout tebdency is going to be continuing for whole 2016.

By the way, EUR/USD was not estimated by Morgan Stanley as the most interesting/profitable pair to trade in 2016: the price is on bearish market condition and the secondary ranging is expected for this pair to be moved in 2016.