Opinion: global impact of the Federal Reserve Bank raising interest rates

2 December 2015, 21:14

0

1 423

Many analytics are expecting the global high impact of Fed hike which will be first rate rise in 10 years:

- Trevor Charsley from AFEX is considering that the Fed interest rate rising will affect on the emerging markets because the debt repayments will be increased.

- Jeremy Cook (World First) said about Asian and other emerging markets to have their feet held to the fire in the coming months.

- David Lamb from FEXCO stated that the Fed rate hike is to hit commodity currencies far harder than sterling because BoE.

- Glenn Uniacke at TTT Moneycorp Limited expected for the commodity currencies to be squeezed by the combination of US dollar and prices for commodities (oil and copper).

- Analyst Alexandra Russell-Oliver from Caxton FX said that low oil prices will continue to weigh on Canadian currency going forward but if concerns over stability in the Middle East continue to build (oil prices could see some further gains).

- Myles Birkett from FC Exchange stated that because of slowdown of China economy growth - the flow of money will only increase away into US dollar.

We may see the shock factor if interest rates will not be raised in December, and after that -

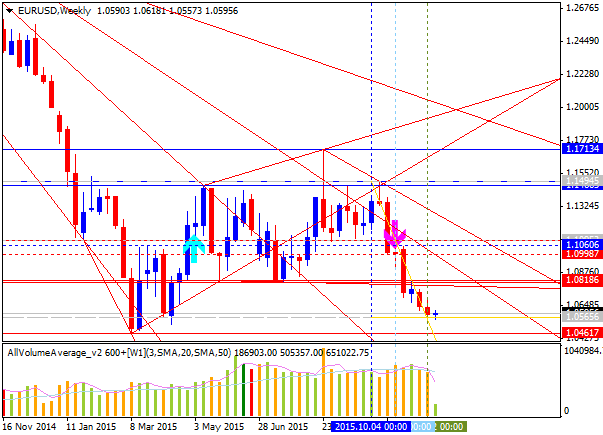

the dollar will fall with the other currencies to be bounced higher, and in this case - the price for EUR/USD will not S3 Pivot level at 0.9344 even if the resistance level at 1.0461 will be broken at year-end for example.