Trading recommendations and Technical Analysis – HERE!

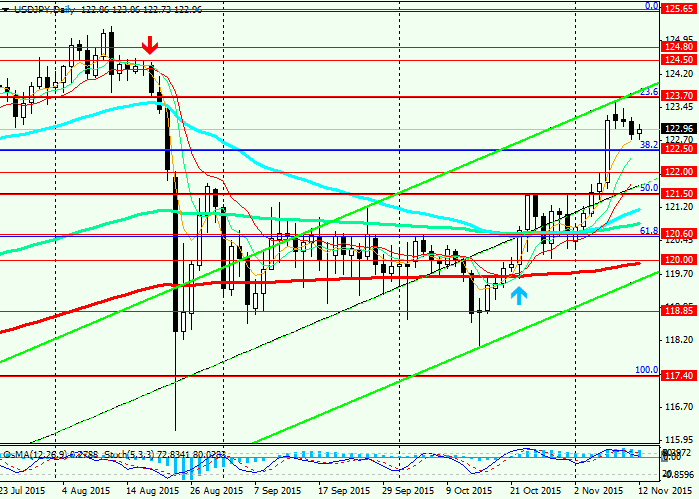

Despite a slight decline from the beginning of the week pair USD / JPY keeps positive dynamics obtained Friday by strong data on US labor market (NFP) in October.

In Asia today, the yen fell against the dollar after the release of US data on the state of the Japanese economy. The price index for corporate goods (DCGPI) declined in October (-0.6% vs. -0.4% forecast in a monthly basis and -3.8% vs. -3.5% forecast in annual terms). This indicator measures the change in the level of prices for corporate goods and allows you to monitor production costs and production cost, as well as inflation in the manufacturing sector. Reducing index indicates a slowdown in the economy, despite the fairly strong growth in industrial orders for machinery and equipment in Japan in September (+ 7.5% versus + 3.3% expected).

China, as a close trading partner of Japan and Japanese goods the buyer is also showing clear signs of an economic slowdown and weakening inflation and domestic demand, in spite of the efforts made by the authorities of the country.

So, according to published data earlier in the week, the consumer price index in China in October compared with the same period last year grew by only 1.3%, while the producer price index for the year decreased by 5.9%. Together with the decline in exports in October (-6.9%) greatly reduced imports (-18.8%) in China, including Japanese goods.

In late October, the Bank of Japan left its asset purchase program unchanged at 80 trillion yen, but the comments of representatives of the bank pointed to the commitment of the Bank of Japan's loose monetary policy. The head of the Bank of Japan Kuroda said that the central bank, if necessary, will not hesitate to further easing.

The Bank of Japan has once again lowered the forecast for GDP growth and inflation for the next year.

Following the presentations in Brussels, ECB President Mario Draghi (8:30 and 10:30 GMT), on which he once again spoke out in favor of expanding the asset purchase program, saying that the ECB reconsider its monetary policy meeting in December, today stands pay attention to the speech of the Fed's Janet Yellen (14:30) and other members of the Federal Reserve. If the speakers touched upon the topic of monetary policy, the volatility in the dollar pairs, including USD / JPY pair may rise sharply.

However, in anticipation of higher interest rates in the US in mid-December, USD / JPY pair will be supported. From news for tomorrow should also pay attention to 13:30 (GMT), when the data will be published on the level of retail sales in the US in October (forecast 0.3% growth to 0.1% in September). Upon confirmation of forecast US dollar and the USD / JPY has strengthened