Some major int'l financial institutions are making fundamental forecasts concerning NFP for today. For example:

- Deutsche Bank stated that EUR/USD price may reach 1.05 as a target;

- Morgan Stanley are talking about intra-day ranging market condition for today for this pair;

- The Royal Bank of Scotland evaluated 3 scenarios soncerning NFP figures: 200k and above, 175k to 200k and 175k or below. And it was made one conclusion only: Short EUR/USD.

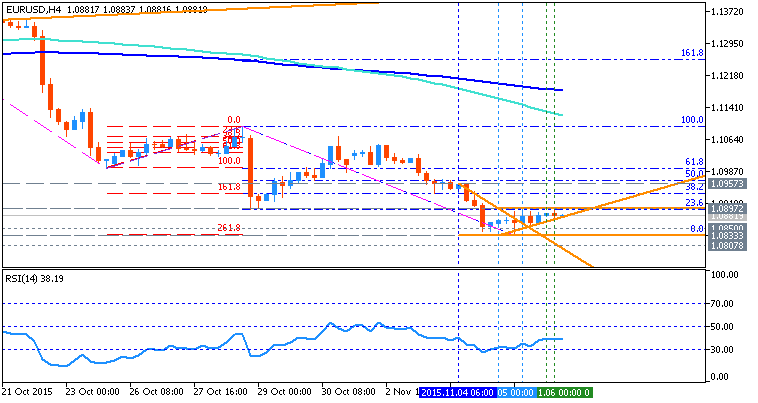

From the technical

point of view - the intra-day price is on bearish market condition

located below 100 period SMA and 200 period SMA.

- If the price will continuing with the bearish condition for today during anf after NFP so 1.0807 may be the nearest bearish target in this case, and the next targets are 1.0461 and year-end target as 1.0059.

- If the price will start with local uptrend as the bear market rally today so the nearest target is 23.6% Fibo resistance at 1.0897 and Fibo reversal resistance at 1.1094 located on the border between the primary bearish and the primary bullish on the chart.