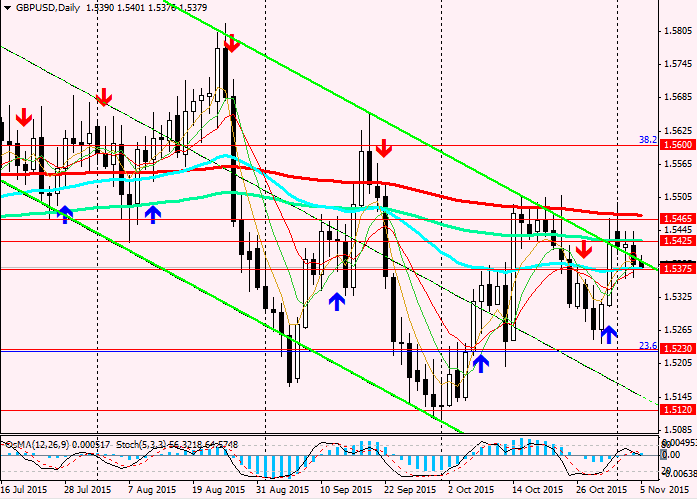

GBP / USD: Bank of England decision on interest rates. Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

In anticipation of the December Fed meeting, and at strengthening the opinion of market participants to raise the interest rate on it, the US dollar is gaining momentum all over the market. The fact that investors are basically put on raising interest rates, says the growth in value of the dollar to gold, silver, as well as the safe-haven Swiss franc and the yen. The yield on 10-year US bonds reached a seven-week high.

Over the past three weeks, the pair has declined as EUR / USD. It can not be said about the pair GBP / USD. His fall in the euro supported the pound in cross-country EUR / GBP, without giving greatly reduces the pair GBP / USD. The pound is also supported in other cross-pairs. The market is awaiting the results of today's meeting and the Bank of England interest rate decision in the United Kingdom (12:00 GMT), as well as comments by the Bank of England to further his monetary policy. Outgoing recently mixed indicators of the UK economy, its close relationship with the economies in the euro area, is still showing weak signs of recovery, the continuing instability of the global economy, for sure, will be reflected in the comments of the Bank of England.

Despite some positive indicators such as the PMI purchasing managers (PMI) in the manufacturing sector in the UK, found themselves better than forecast in October (55.5 instead of the 51.3 forecast and 51.5 in September), the growth of labor productivity and Retail sales in the United Kingdom, GDP growth remains weak. Thus, the GDP in the UK for the 3rd quarter, was at the level of 0.5% (below the forecast of 0.6%).

Changes in the interest rate and monetary policy in the direction of its tightening, so the Bank of England is not expected. The probability of a rate hike has moved closer to the middle of 2016. The volatility in the pair is likely to intensify closer to the performance of the Bank of England Governor Mark Carney (12:45 GMT), which is famous for its ability to find the right words that can have a strong impact on the market and the movement of the pair GBP / USD.

Nevertheless, despite the continuing trend GBP / USD pair continued to decline, the pound will be supported in his purchases in a cross-pairs, primarily the euro, as well as the release of economic data from the US, if they are worse than forecast.

From the news today also pay attention to data on the number of jobless claims in the US for the last week and the speech Fed members, including vice president of the Federal Reserve of Stanley Fischer (13:30 GMT).

When carrying out commercial transactions should also take into account the average daily volatility in the pair GBP / USD, which in the last 3 months is 115 points.

See also review and trading recommendations for the pair USD/CAD!