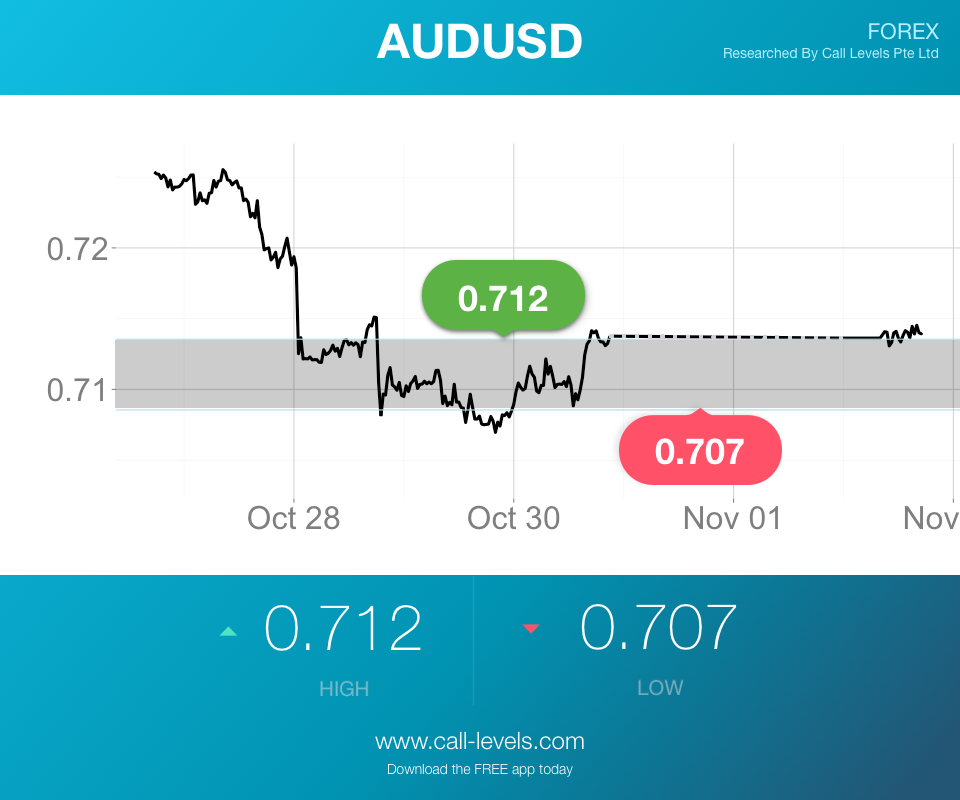

With the US Federal Reserve much more hawkish than expected, this week looks to be a further round of musical chairs as investors figure out where each central bank stands - ahead of the Fed, or dovishly far behind it. Expect volatilty in gold, and in AUD this week.

Will prices of gold rise? - http://www.calvl.co/8G4j3gO0/

Call Levels users think that AUDUSD will drop past 0.712 - http://www.calvl.co/zJqqzKJ1/

Will prices for WTI Oil continue to rise? - http://www.calvl.co/BX9xL2Gn/

Stock Pick of the Week

For this week's Stock Pick, we are looking at a potential Short Position on GS-NYSE. Goldman Sachs Group had a reasonable earnings announcement mid October which helped lift its Stock price away from $168 low at the end of September. There is so much news that comes out for GS-NYSE, including investigations into fraud in Malaysia and the fact that it has under performed in the financial sector this year means the overall Bearish Trend that started in June 2015 could well take over again.

Technically this pull back during October is a classic Elliot Wave 4 pull back with its peak finding resistance just under the $192 price, 89 Day Moving Average and the 0.5 Fibonacci Retracement level taken between the extremes of Wave 2 and Wave 3. This resistance level is also a previous resistance level during the Wave 3 when the Stock price went into a corrective phase and is backed up by my TJ's Ellipse being taken out at the Wave 4 extreme.

The Oscillator Pull back is also with parameters, in that it has not breached 140% of the Wave 3 extreme, which can be seen on the Oscillator study at the foot of the chart below. (Oscillator compares the 5 and 35 day Moving Averages and displays them in oscillator form, in yellow).

With all this in mind I still want to be conservative on my entry, just in case the US markets have a very Bullish week and drag up financial sector stocks in a corrective pattern. The entry will be outside of my trend channel and below the 6/4 MA Low (RED MA line close to Red Trend channel exit).

Stop Sell Order at $182.69 with my Stop Loss at $192.25. The potential target price of $152.00 gives a great 1:3 Risk to Reward Profile.

Stop Sell $182.69 - http://www.calvl.co/KOYQRnOZ/

Stop Loss $192.25 - http://www.calvl.co/9JKj9gOr/

Price Target $152.00 - http://www.calvl.co/ZOkBoPXB/

[Adapted from http://blog.call-levels.com/recommended-call-levels-for-this-week-02112015/ . Reproduced with permission]