USD/CAD: against a background of increasing global oil production.Trading Recommendations

Trading recommendations and Technical Analysis – HERE!

The level of consumer spending in the US in September rose by 0.1% compared with the previous month (forecast 0.2%). The price index for personal consumption expenditures (PCE) in September decreased by 0.1% compared to August (forecast 0.2%) and grew by only 0.2% per year. These data, which were published on Friday, will allow market participants to record long positions in the US dollar, as It showed that inflationary pressures in the US is at a minimum close to zero values of levels.

Against the background of negative data from the US, data on stocks of petroleum and petroleum products in the US for the last week of October, showed less than forecast growth (3.376 million barrels instead of the growth of 3.417 million and 8.028 million in the previous period), and in anticipation of the heating season, oil prices have adjusted to the lows reached earlier and closed the week in positive territory above $ 49 per barrel mark Brent. On Friday, oil futures for Brent crude on the NYMEX rose by 1.2%.

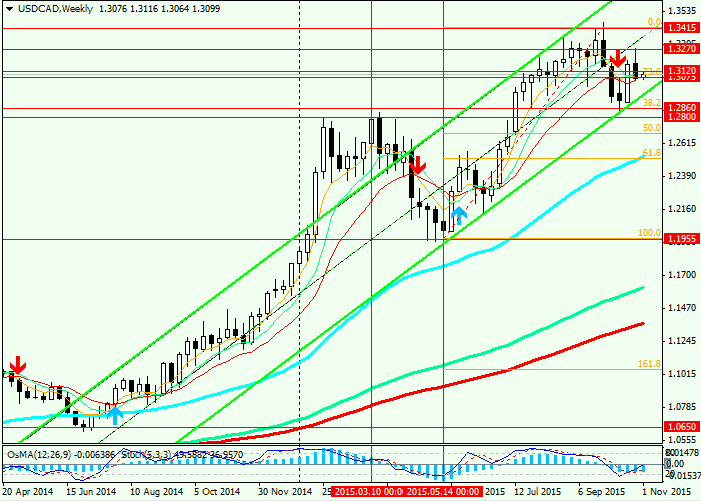

The pair USD / CAD, which has an inverse correlation to oil prices of 92%, also fell on Friday, closing the trading week in negative territory, despite weak GDP data in August in Canada.

Earlier in October, the Bank of Canada left its key interest rate unchanged at 0.5%, and noted that to sustain growth, inflation and the economy the Bank of Canada will be inclined to hold soft monetary policy. According to the Bank's inflation will remain below the target level of 2% before 2017, and the forecast of economic growth in Canada for 2016, 2017 has been lowered. Weak investment companies will constrain economic growth in 2016, while investments in the energy sector is forecast to decline by 20%. Full utilization of the Canadian economy is now possible not earlier than in 2017.

On the other hand, in a slowing global economy and excess supply of oil to the world market price of oil will remain under pressure in the medium term.

In this regard, the Canadian dollar will be vulnerable, and the USD / CAD pair will remain in the medium-term trend is growing, despite the Fed's actions in regard to raising interest rates in the United States.

Warning the financial markets will be focused on data on the state of the labor market (Non-Farm PayRolls) for October, scheduled for Friday of this week.

If the index would be worse than forecast (180 000 new jobs), the probability of a rate hike in the US this year, considerably reduced. Dollar undergoes the sale of the entire market, and the prospects of higher interest rates in the US will be shifted to 2016.

In addition to news from the US this week published several important news for Canada, the most important of which will be data on unemployment and employment in Canada in October, scheduled for Friday.

See also review and trading recommendations for the pair AUD/USD!