Trading ideas for USD/JPY: the BoJ meeting could be a big event

28 October 2015, 12:11

0

1 481

UBS Group made a weekly technical forecast making the trading recommendations for the USD/JPY pair related for the trading.

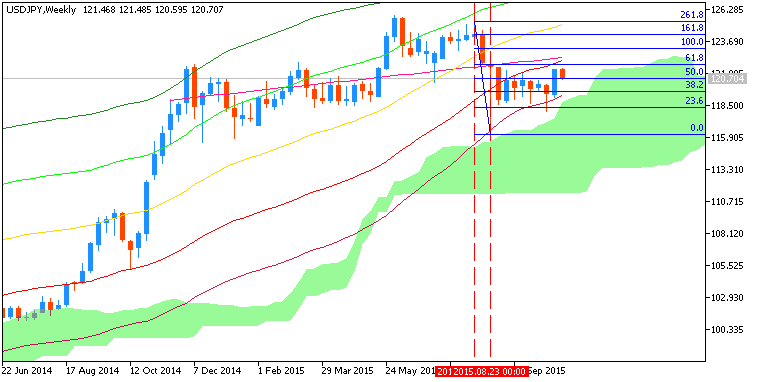

USDJPY:

- "We have seen some profit-taking ahead of the FOMC and BoJ meetings this

week. Nothing is expected from the FOMC, but the BoJ could be a big

event."

- "The pair should stay supported heading into the meeting, so look to buy

dips closer to below 120.50, with a stop below 120.00. There is good

resistance between 121.70 and 122.00."

The

price is trading to be above Ichimoku cloud for primary bullish market condition with the secondary ranging within Fibo resistance at 123.10 and 23.6% Fibo support level at 118.32. Fibo resistance at 123.10 is located above Ichimoku cloud in the primary bullish area of the chart, and 23.6% Fibo support level at 118.32 is located to be inside Ichimoku cloud in the ranging bearish area.

If the price will break 23.6% Fibo support level at 118.32 from above to below so we may see the reversal of the price to the primary bearish with the secondary ranging.