Stop adding junky stocks to your portfolio, says strategist Adam Parker and his team at Morgan Stanley.

The banking institution divides stocks into four different sets — high, moderate, low quality or junk — and says hedge funds have been in favor of the latter, owing to market volatility.

Calling on investors to break away from this tendency, Parker says now is high time to raise exposure to high-quality firms. He refers to compelling free-cash-flow yield (used by those who think cash flow is a better sign than earnings of how much a share will return) and valuations in his rationale.

Thus, Parker has added 4% to the high quality set and trimmed the same

amount from the lower quality pile.

Morgan Stanley now owns Starbucks, Discover Financial Services, American Express, Capitol One and MasterCard, while it has got rid of 21st Century Fox and Huntington Bancshares.

“We continue to think the consumer will spend more, and we like

owning the credit cards as a way to play this theme,” says Parker.

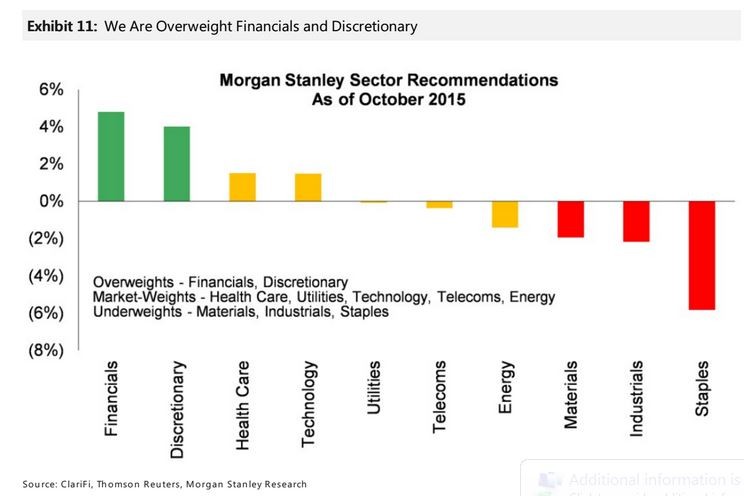

His top-five high quality stocks are Apple, Pfizer, Verizon, Oracle and UnitedHealth. Below is a chart of the team’s latest sector recommendations: