Goldman expects pound to strengthen, says Bank of England might hike rates sooner than expected

Goldman Sachs Asset Management expects the British currency to jump against the dollar as the Bank of England will possibly increase interest rates sooner than the market predicts.

GBP/USD has dropped about 3

percent from this year’s peak as market players have

pushed back estimates to beyond December 2016 for when the Bank of England will tighten.

The pound fell from this year’s high of $1.5930 set on June 18 to as low as $1.5108 on September 30.

Goldman Sachs Asset Management forecasts the BOE will probably increase rates in the first quarter and the marketplace is underestimating this threat, said Philip Moffitt, Asia-Pacific head of fixed income at the firm in Sydney.

U.K. data this month has signaled the jobless rate surprisingly dropped to the lowest level since 2008. Wage growth, excluding bonuses, was near the highest in six years. Higher interest rates are positive for currencies as they provide a greater return for investments.

“When we look at all the major economies, the U.K. seems to be the one where the labor market tightening up actually seems to be generating some signs of wage inflation,” said Moffitt, adding that Goldman has had a view for a while that the central bank would be acting in early 2016, and they have not done anything to change this view.

“You’ve had quite extreme moves to levels that now look to us to be a bit cheap,” he said. When you link that to positioning, a change in Fed rhetoric and market pricing for tightening “we’ve shifted the portfolio a little bit,” he said.

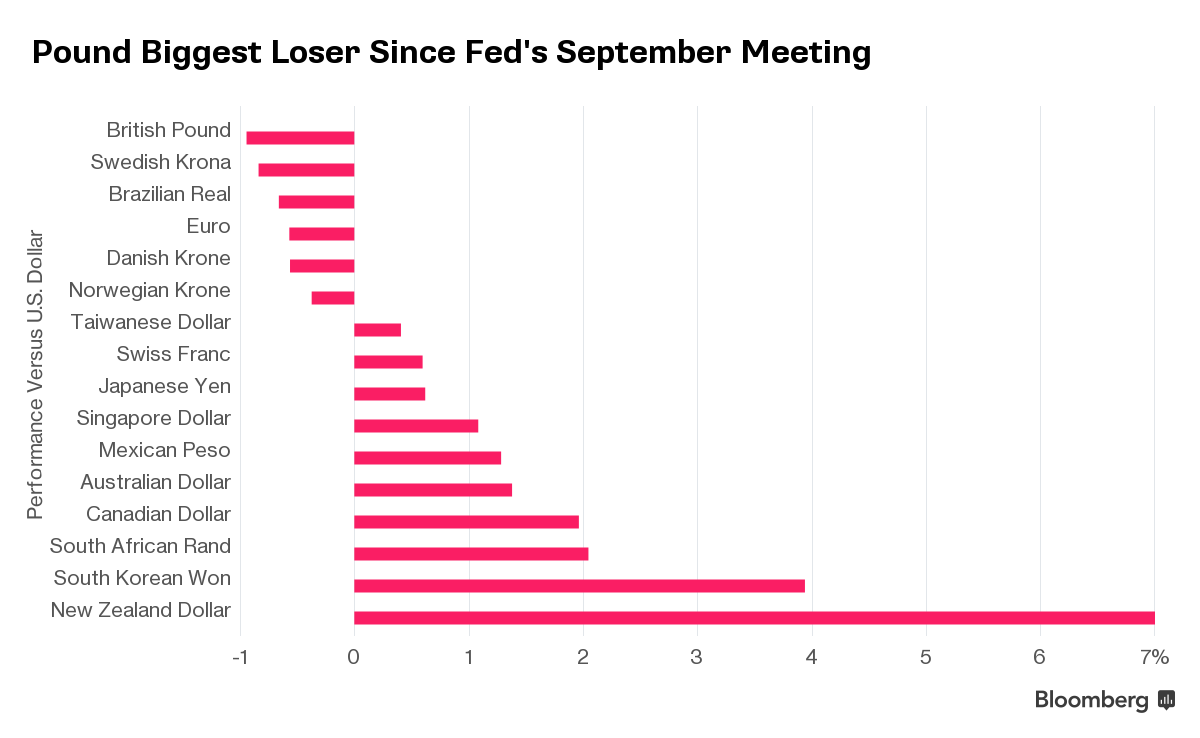

Sterling has dipped against all except one of its 16 major counterparts since the Federal Reserve’s September 17 decision to stand pat on its monetary policy. In its policy statement, the Fed referred to increased global risks driving speculation the same reasons will restrain the U.K. central bank. Since that time, sterling has dipped 0.8 percent against the greenback.

Last week Bank of England official Kristin Forbes said that the next move in U.K. interest rates will be higher and it should happen “sooner rather than later.” The nation’s economic realities can withstand today's difficulties in emerging markets, and domestically led growth “shows all signs of continuing, even if at a more moderate pace,” she said in a speech on Friday.

Markets, however, seem to have shrugged off her confidence. Forward contracts based on the sterling overnight index average, or Sonia, suggested a full 25 basis-point increase in the BOE’s key rate won’t happen until later than December 2016. The central bank has kept its benchmark at a record-low 0.5 percent since March 2009.

In the meantime, hedge funds and other money managers raised net bearish bets on the British currency to 7,527 contracts in the week through Oct. 13, from 4,533 the previous week, says the Commodity Futures Trading Commission in Washington. The data also showed that similar bets dipped for every other major currency including the euro, yen and Australian dollar during the period.