What could go wrong if Fed does decide to hike? 5 risks

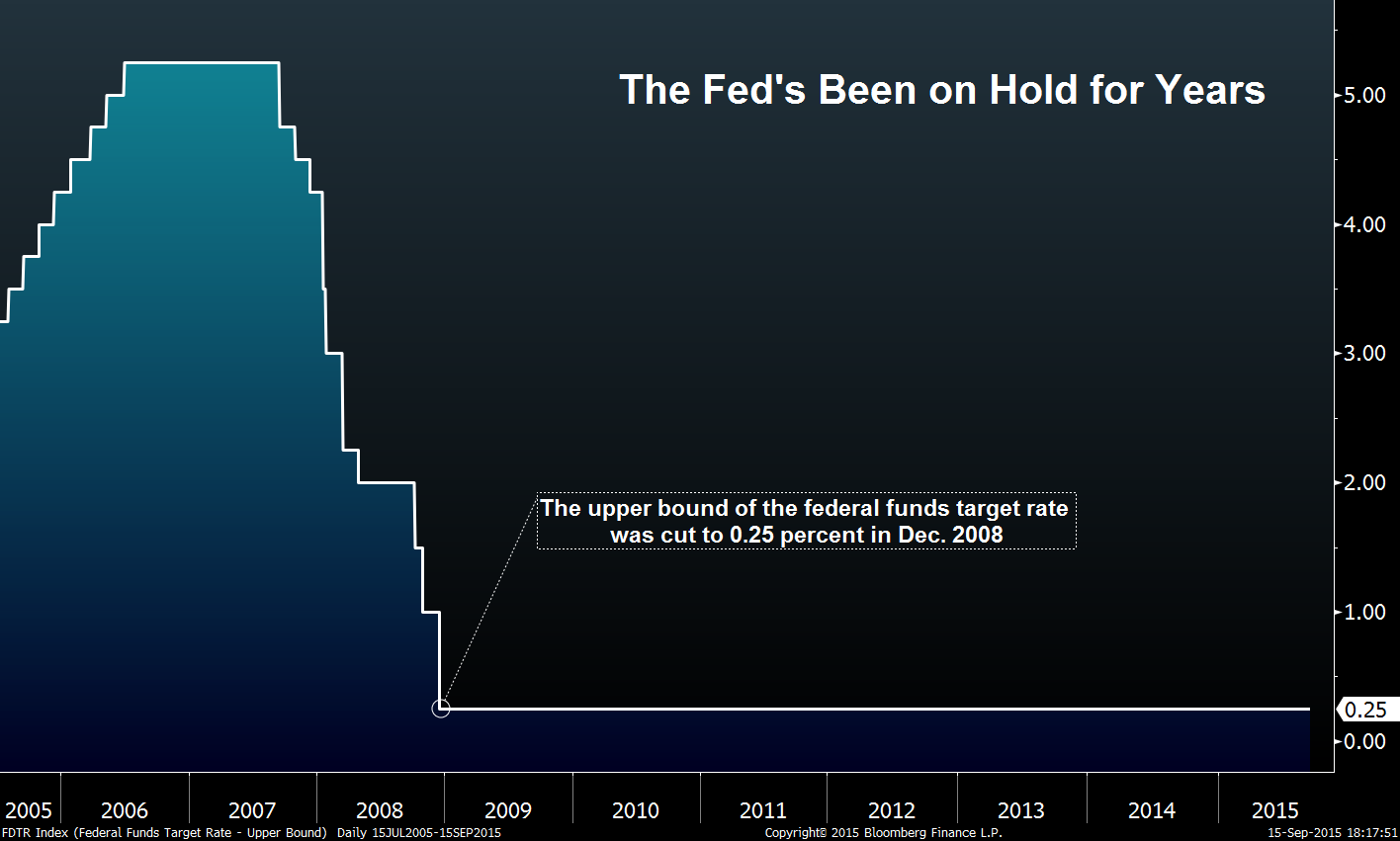

So if the Federal Reserve does decide to increase rates this week, what could potentially go wrong?

Plenty, Bloomberg says. Even those who are quite optimistic say there are weak spots that market players should keep in mind, while pessimists have certain ideas:

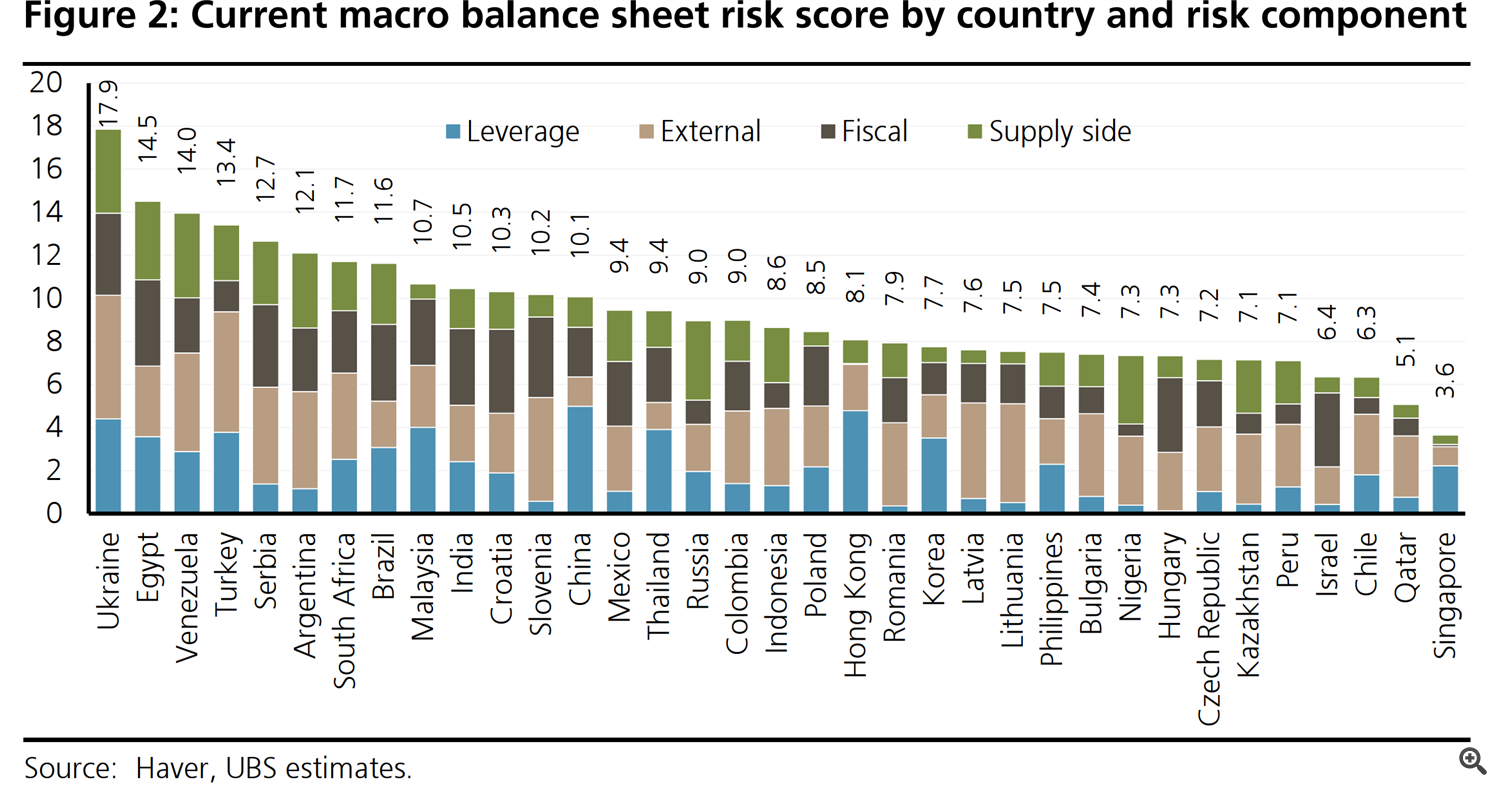

1) Emerging markets turmoil. Developing countries that rely on foreign capital to finance their current account deficits will likely get into trouble, as higher rates in the U.S. would threaten to wash this capital away. In a report last month, Morgan Stanley identified Brazil, Indonesia, South Africa and Turkey as the riskiest. UBS AG also listed Ukraine, Egypt and Venezuela as the most vulnerable, based on their debt and strength of finances.

A number of analysts, including chief economist at World Bank and best-selling author of "The Death of Money" warned the rout in EM is likely.

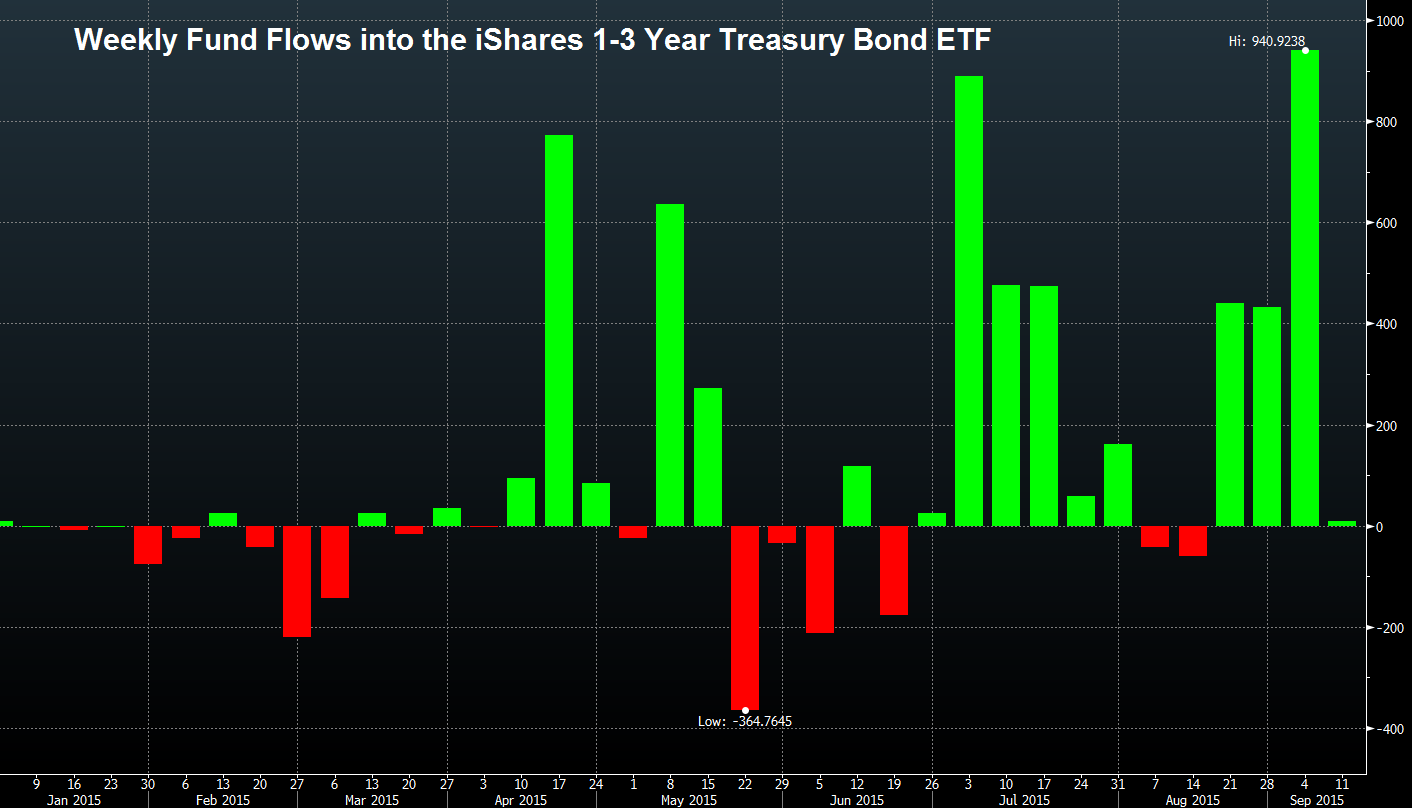

2) Short-end tantrum. Two years ago, just a mention of hiking rates triggered long-term Treasury yields to jump. This time around, short-term U.S. debt may suffer the most, which prove to be an unpleasant surprise for those who sought an asylum in the securities during last month’s stock-market turmoil. Investors have pumped more money into the iShares 1-3 Year Treasury Bond ETF this year than any other exchange-traded debt fund. On Tuesday, the two-year paper plunged as yields surged to the highest since 2011.

Peter Tchir, the head of macro strategy with Brean Capital LLC, noted that there is also a danger that selling from international investors will exacerbate losses in short-term Treasuries if the dollar, which almost everyone expects to rally as rates rise.

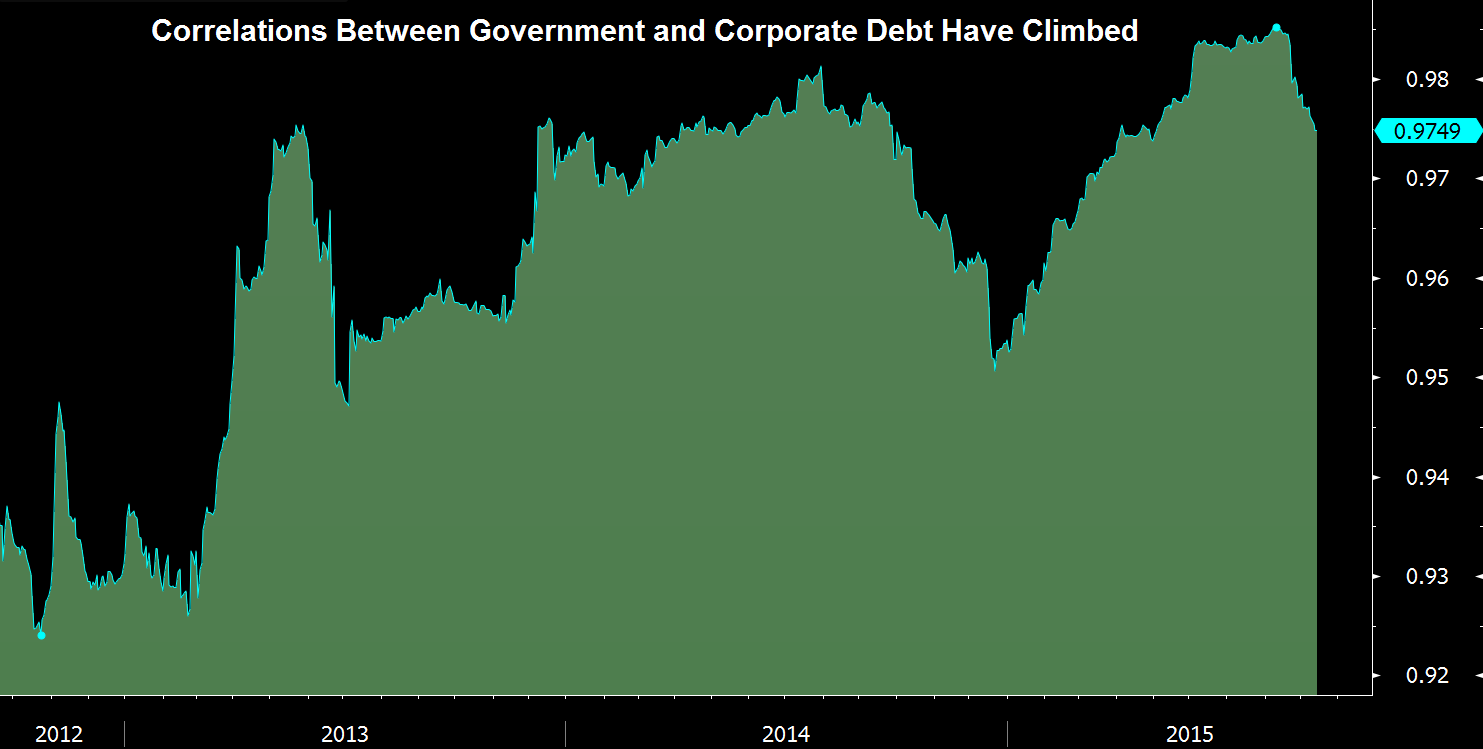

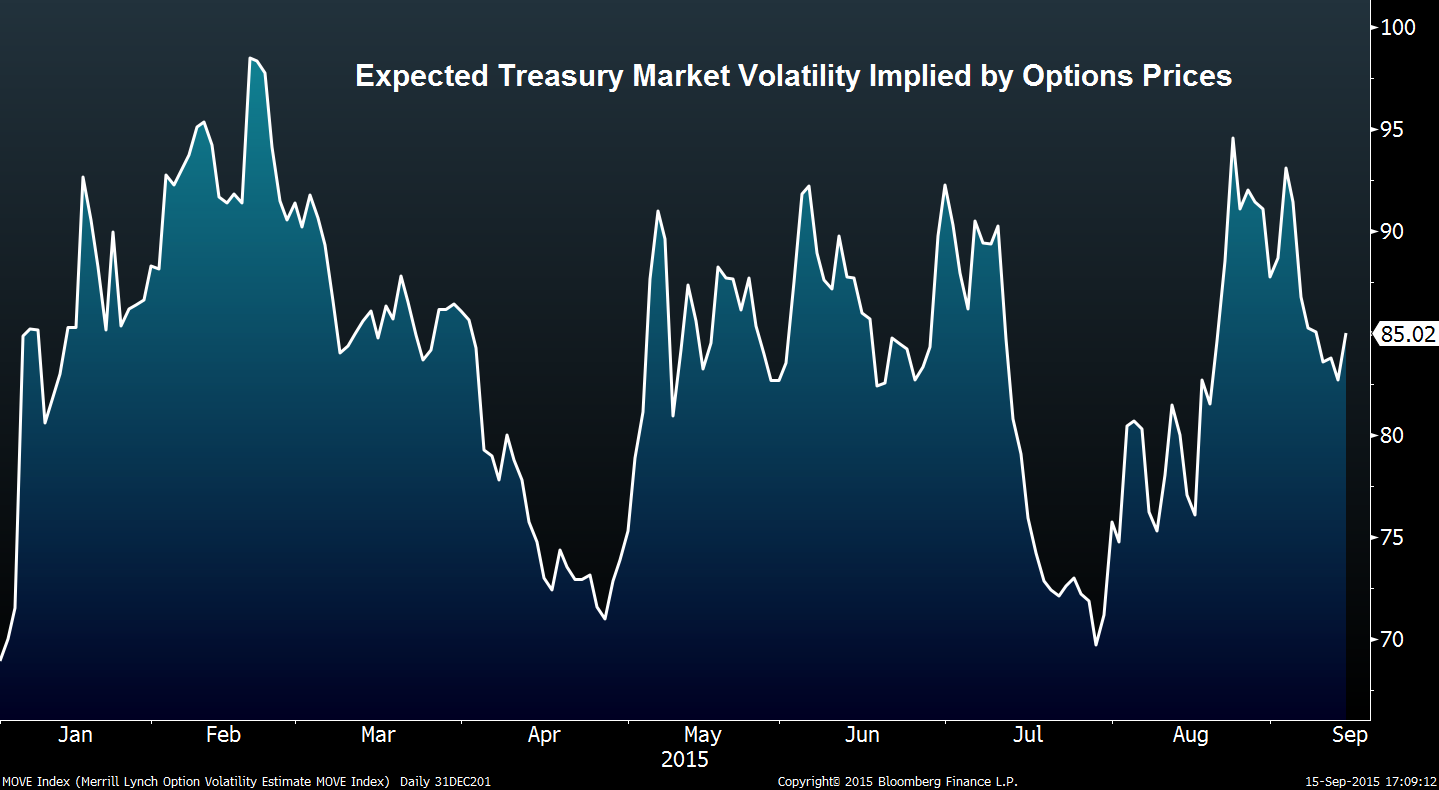

3) Jeopardized borrowers. Although it's not surprising that higher rates would raise corporate borrowing costs, stronger volatility in Treasuries could affect even the safest company debt. Last month, fluctuations in investment-grade bonds were more correlated to Treasuries than any time in four years, says Bloomberg. Firms still have a significant financing needs, with borrowers looking to fund $458 billion of takeovers expected to close by year-end.

Analysts, including Tchir, agree that it will be harder for companies to issue debt if there is a selling pressure in the Treasury market.

4) Structural seizures. Bloomberg also notes that the rise of computers and the fall of Wall

Street’s bond dealers as traditional middlemen has shifted the nature of

trading Treasuries in ways which are hard to predict. Last October’s “flash crash”

in Treasury yields is just one example.

5) Risk of not changing. Even so, there’s a widening group of experts, or even pundits who say maintaining rates at zero could lead to even bigger threats. That’s because postponing the hike could trigger a larger turmoil in financial markets as traders try to decipher the Fed’s intentions. It also has the potential to trigger more risk-taking in sectors that are already overheated.