Current trend

The AUD strengthening today was due to improving business conditions in August in Australia, according to the latest data.

However, in the second quarter the Australian GDP only grew by 0.2%, compared to a 0.9% growth for the first quarter. Furthermore, a trade balance deficit in July of 2.46 billion AUD, growing concerns of the economy slowdown amid the Chinese crisis, and falling commodities prices can force the RBA to cut its interest rates before the end of the year.

On Wednesday and Thursday, important news are due from Australia, as well as two RBA Deputies speeches. A high volatility in the pair is expected.

Support and resistance

From the fundamental point of view, the AUD/USD pair is under pressure and may well fall towards 2004 (0.6800) and 2008 lows (0.6000).

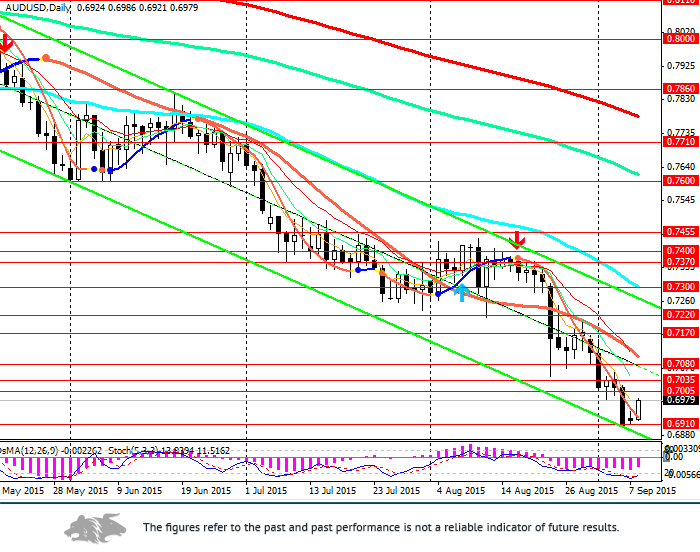

OsMA and Stochastic on the 4-hour chart formed a buy signal, while on the daily, weekly and monthly charts they signal sales.

Support levels: 0.6960, 0.6910.

Resistance levels: 0.7000, 0.7035 (ЕМА50 on the 4-hour chart), 0.7080 (upper border of a descending channel), 0.7100, 0.7170 (ЕМА144), 0.7220 (ЕМА200 on the 4-hour chart).

Trading tips

Open short positions from the levels of 0.6990, 0.7030 with targets at 0.6910, 0.6885, 0.6800 and stop-loss at 0.7090.

Long positions can become viable in the medium-term after the price consolidation above the level of 0.7300.