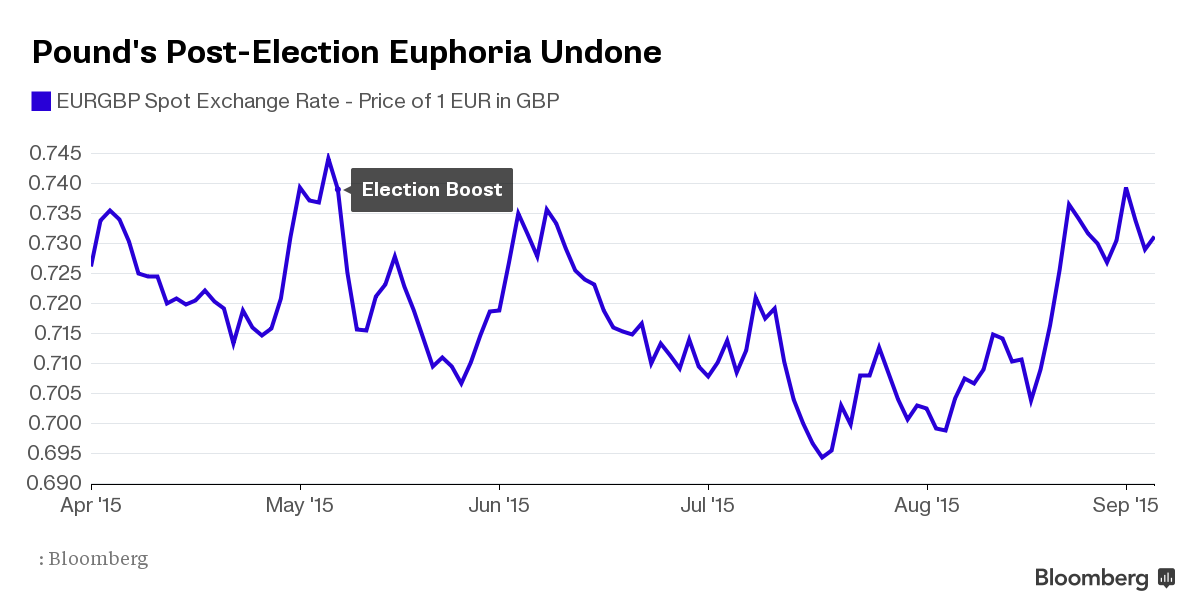

Pound's longest fall in three years proves upbeat forecasts were far from being true...

The pound sterling is already 3 percent weaker than the consensus third-quarter forecast of analysts surveyed mid-year.

On Friday the British currency dropped against the euro even after the European Central Bank signaled its readiness to expand monetary stimulus to combat the region’s latest bout of disinflation.

The pound also dipped for a ninth day against the greenback in its longest losing streak since 2008. Its gains have been washed away since getting a boost from the U.K. elections in May, when an expanding economy prompted investors to anticipate an early interest-rate increase from the Bank of England.

The pound is already weaker than the 71 pence strategists forecast for the end

of this quarter in a June 30 Bloomberg survey. Steve Barrow, head of Group-of-10 strategy at Standard Bank Group Ltd. in London, now forecasts an

advance to about 65 pence.

“The generally bullish mood after the elections meant the majority of traders and investors were positioned that way,” he said, adding that when things didn’t turn out necessarily so good, there was some position squaring.

Reports this week on services, construction and manufacturing all fell short of economists’ forecasts, which may lower the chance of increasing official borrowing costs. And, as Bloomberg puts it, the falls suggest sterling is losing its status as the darling of the forex markets amid signs the economy is starting to lose momentum.

Analysts see a possibility that the Bank of England will keep its main interest rate at a record-low of 0.5% for longer is also mirrored in government bonds.

Benchmark 10-year gilt yields dropped five basis points, or 0.05 percentage point, to 1.85 percent. The 2 percent bond due in September 2025 rose 0.48, or 4.80 pounds per 1,000-pound face amount, to 101.36.