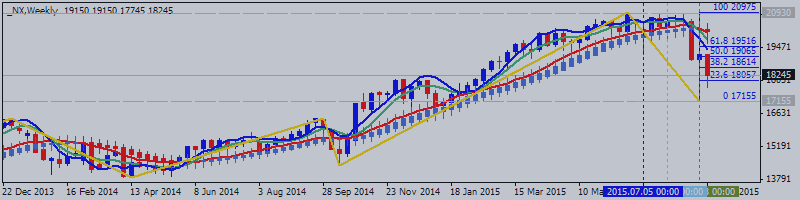

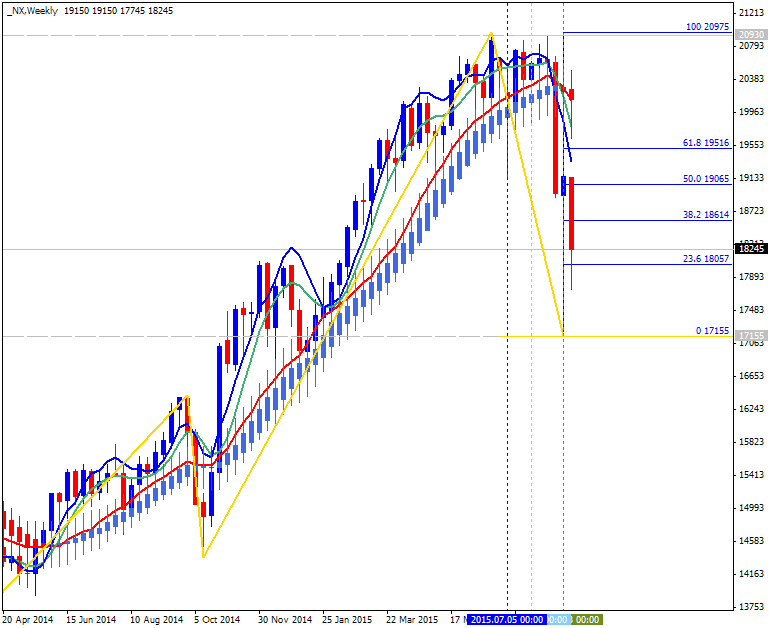

NIKKEI 225 Index Outlook for September - correction to bearish breakdown

4 September 2015, 06:11

0

697

W1 price is on bullish market condition with secondary correction with the following key levels:

- 20975 key resistance level located far above Ichimoku cloud; if the

price breaks this level from below to above so the bullish trend will be continuing.

- 17155 key support level located inside Ichimoku cloud below Senkou Span A line in the ranging bearish area of the chart; if the price breaks this level from above to below so we may see the reversal of the price movement to the primary bearish market condition with the secondary ranging and 16565 as the next bearish target.

Chinkou Span line crossed the price from above to below for good breakdown to be continuing.

If W1 price will break 17155

support level so we may see the reversal of the price movement to the primary bearish

market condition with the secondary ranging and 16565 as the next

bearish target.

If W1 price will break 20975 resistance level so the primary bullish trend will be continuing.

If not so the price will be ranging between the levels.

Trend: