Gold futures hit session's lows

after data signaled that the U.S. economy grew more than initially

estimated in the second quarter, boosting optimism over the health of

the economy.

The US dollar index reached 95.79, up 0.51%, after the news.

Comex gold for December delivery dropped $5.30, or 0.47%, to trade at $1,119.30 a troy ounce during U.S. morning hours after hitting a daily low of $1,119.10.

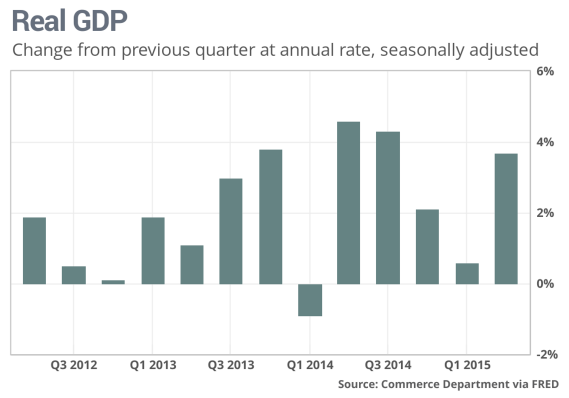

The Commerce Department said the U.S. economy grew 3.7% in the three months ended June 30, above expectations for growth of 3.2%. Preliminary data initially pegged U.S. growth at 2.3% in the second quarter.

Personal consumption climbed 3.1% in Q2, matching expectations and up from an initial estimate of 2.9%. Consumer spending typically accounts for nearly 70% of U.S. economic growth.

What’s more, newly revised figures from the Commerce Department shave signaled that businesses invested at an even faster rate.

Businesses extended investment by 3.2% increase of a drop of 0.6%, with spending on structures such as office buildings rising by 3.1% instead of a drop of 1.6%.

One reason businesses might have invested more: Corporate profits jumped an estimated 2.4% in the second quarter after declining by 5.8% in the first quarter. And they boosted spending on equipment by 10.7%, rather than 7%.

Soft business investment played a key role in the brief but steep first-quarter slump, MarketWatch has reported. Many companies had to close or delay major projects amid a bout of extremely cold or stormy conditions that also made it hard for employees to get to work.

Separately, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits declined by 6,000 last week to 271,000. Economists had expected initial jobless claims to fall by 3,000 to 274,000 last week.

First-time jobless claims have held below the 300,000-level for 25 consecutive weeks, which is usually associated with a firming labor market.