Current trend

Despite a larger number of employed, the unemployment rate in Australia in July grew from 6.1% to 6.3%.

The AUD/JPY pair is supported by the difference in interest rates in Japan (0.1%) and Australia (2%), and extra-soft monetary policy by the Bank of Japan.

The pressure on the pair comes from low inflation in Australia, falling commodities prices, economic slowdown and the stock market crisis in China.

On Friday, the Bank of Japan Monetary Policy Statement and the Governor Kuroda Speech are due, at 6 am (GMT +3). However, the key event of the week that needs to be watched is the release on NFPR in the US at 3:30 pm (GMT +3). The publication would allow seeing the prospects of the interest rate hike in the US in September.

Support and resistance

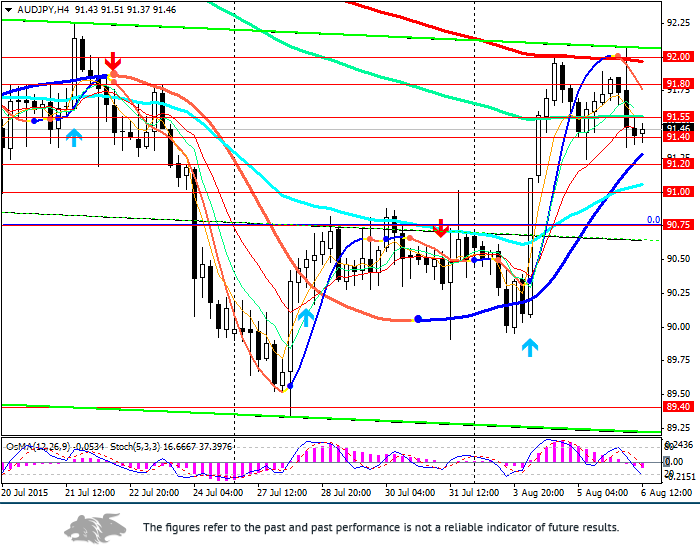

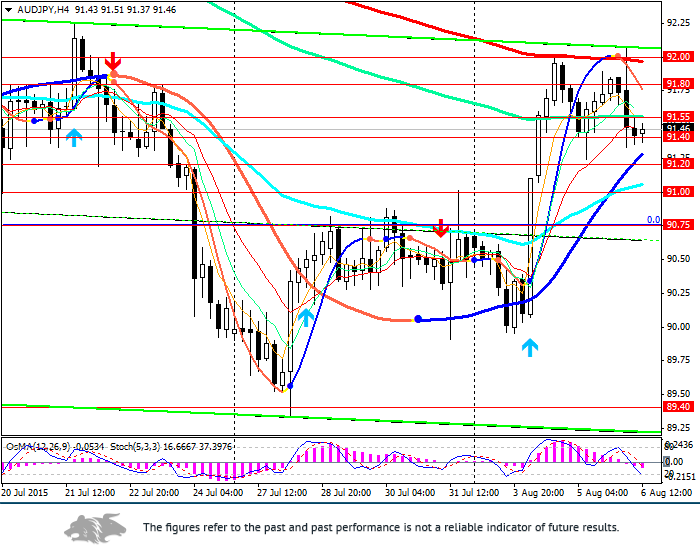

The AUD/JPY pair rebounded from the resistance levels at 92.00 (EMA200) and 91.55 (EMA144 on the 4-hour chart) and stabilised near the level of 91.40 (EMA200 on the weekly chart).

The pair continues moving within a wide (89.50-93.45), medium (90.75-92.50) and narrow (91.00-92.00) ranges.

The breakout of the level of 92.00 would allow the pair to grow to 92.75, 93.45, 94.30, while the breakdown of the level of 90.75 would let it fall to 89.40, 88.00, 82.00.

Technical indicators on the 4-hour chart turned down. On the daily chart, they remain in the buy zone.

Support levels: 91.40, 91.00, 90.75, 90.00, 89.40.

Resistance levels: 92.00, 92.75, 93.45.

Trading tips

Place pending buy orders at the level of 92.50 with targets at 92.75, 93.45 and stop-loss at 91.80.

Pending sell orders can be placed at 91.20 with targets at 91.00, 90.80, 89.40, 88.25 and stop-loss at 91.70.