USD/JPY - Deutsche Bank believes in robust US economic indicators, we believe in Pivot Points

5 August 2015, 09:11

0

765

Deutsche Bank made a forecast for USDJPY for August-October 2015 and for 2016:

- August-October 2015

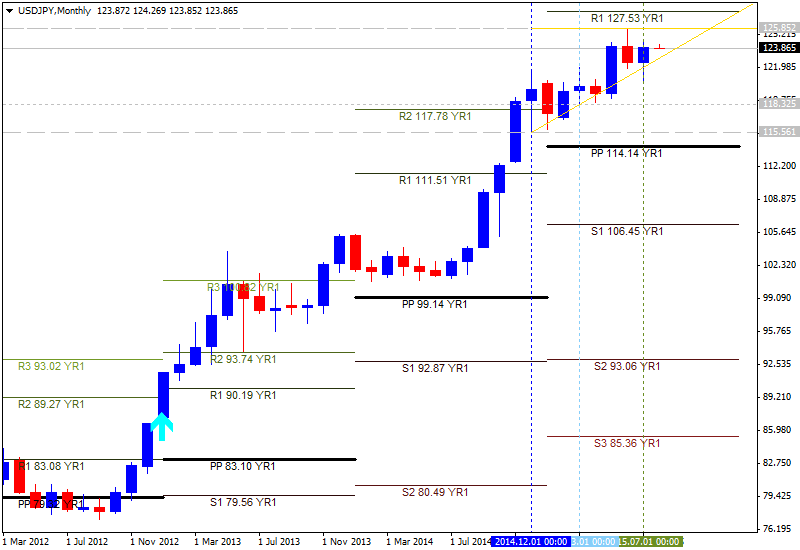

"We believe the USD/JPY could jump to a ¥125-128 level over the next few months in reflection of robust US economic indicators." - 2016

"We expect the USD/JPY to strengthen in August-October and edge upward to only around ¥130 throughout 2016."

Let's evaluate this situation using Pivot Points and s/r levels.

- S/R levels

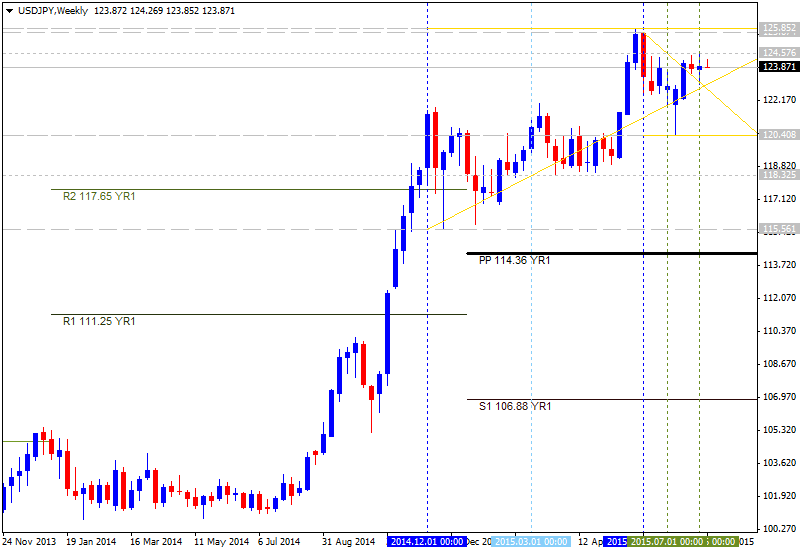

If we look at USDJPY W1 timeframe so we see the price broke symmetric pattern from below to above for the bullish trend to be continuing, with 125.85 as the nearest resistance level, and the price is located for now between 120.40 support and 125.85 resistance so 125.85 is the real target for now. - Pivot Points

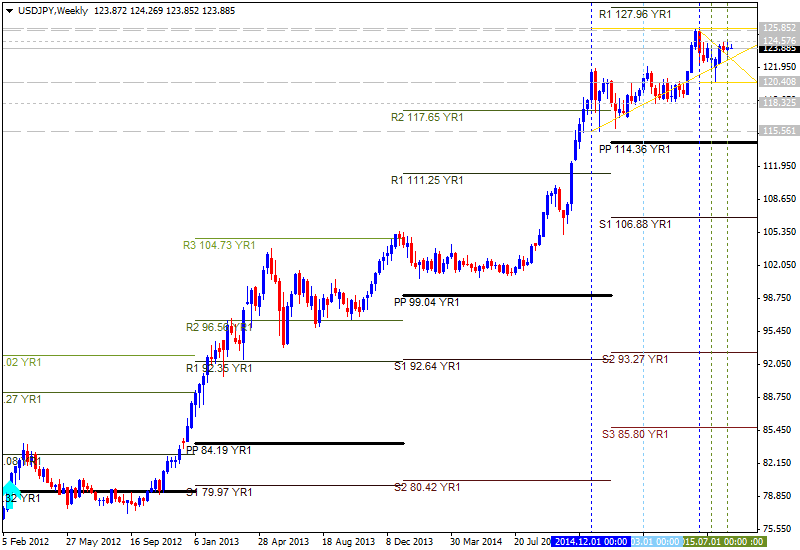

The price is located to be above yearly Central Pivot at 114.36 and below R1 Pivot at 127.96. It means the bullish market condition with secondary ranging.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot | R2 Pivot |

|---|---|---|---|---|

| USD/JPY | 106.88 | 114.36 |

127.96 | 135.22 |

If we summarize above mentioned data so we can understand the following: the price is on primary bullish condition with the nearest target as 125.85. The next target is R1 Pivot at 127.96, and we may expect for the next target to be broken by the end of this year for example.

As to 2016 so it may be much easier - R2 Pivot level is located at 135.22 and it will be the next target in 2016 if the price will break 127.96 by the end of this year.

Thus, the forecast of Deutsche Bank was confirmed: ¥125-128 during August-October 2015, and around ¥130 in 2016.