European stocks remain near 4-month lows amid Greece talks; U.S. stocks to open higher

The Greek crisis is now hurting stocks that had been buoyed by the European Central Bank’s stimulus program in the first quarter.

The Stoxx Europe 600 Index added less than 0.1 percent to 378.82 at 10:32 a.m. in London, after rising as much as 0.4 percent.

The benchmark gauge for European equities is recovering after touching a four-month trough on Monday. It closed 8.5 percent away from its

April record after Greeks rejected austerity measures in a

referendum on Sunday.

Prime Minister Alexis Tsipras is on his way to Brussels in a last-ditch attempt to further negotiate a bailout with the European leaders and keep his country in the euro region. Finance ministers and leaders from the 19-member region gather Tuesday afternoon.

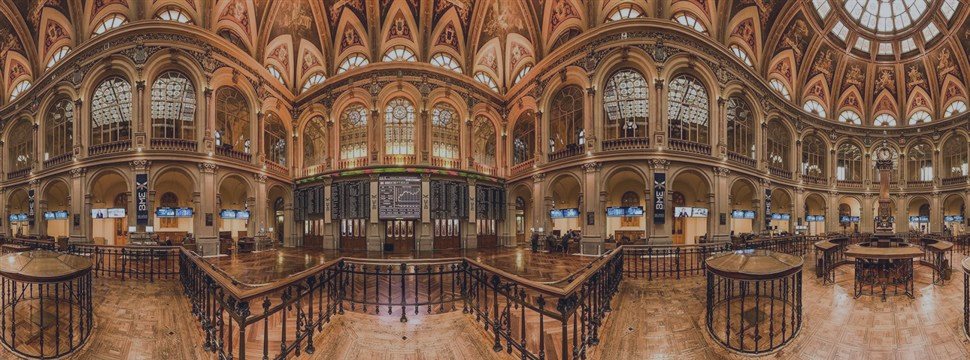

Spain’s IBEX 35 Index and France’s CAC 40 Index also entered a correction on Monday.

Italian equities were among the biggest gainers in western-European markets after the FTSE MIB Index entered a correction on Monday. The measure regained 0.3 percent, and Portugal’s 20 Index rose 0.4 percent.

Greece’s stock market will remain closed on Tuesday and Wednesday after a bank holiday was extended. A U.S.-listed exchange-traded fund tracking Greek equities slid 0.8 percent in early New York trading after a 7.5 percent decline on Monday.

In the meantime, U.S. equities are expected to start a day on a positive note, as investors await trade data due at 8:30 a.m. EST.

At 10 a.m., a report on job openings for May is awaited, and at 3 p.m. consumer-credit numbers for the same month are expected.

Barclays analysts said in a note that “trade data have been volatile in recent months as a result of the West Coast port strikes that were resolved in mid-February.”

“Exports have softened over the past six months on weak international

demand and the stronger dollar. Container volumes for May suggest a

modest uptick in imports and a decline in exports, which we expect to

lead the deficit to widen,” they added.

Futures for the Dow Jones Industrial Average rose 73 points, or 0.4%, to 17,700. Those for the S&P 500 index added 10.90 points, or 0.5%, to 2,075.25. Futures for the Nasdaq 100 index rose 19.75 points, or 0.5%, to 4,442.59.