MACD Hidden divergence is used as a possible sign for a trend continuation. This setup occurs when price retraces to retest a previous high or low.

- Hidden Bullish Divergence

- Hidden Bearish Divergence

Hidden Bullish Divergence

- Forms when price is making a higher low (HL), but the MACD oscillator is showing a lower low (LL).

- Hidden bullish divergence occurs when there is a retracement in an uptrend.

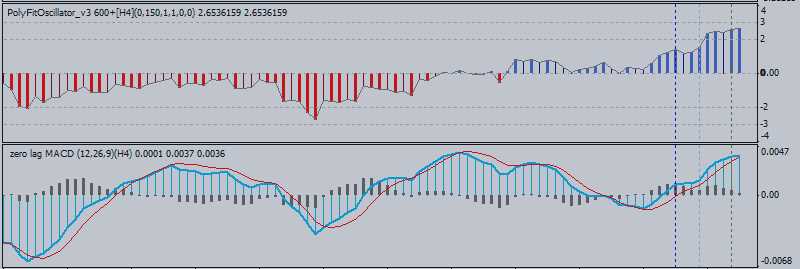

MACD bullish divergence

- This divergence confirms that a retracement move is complete. This divergence indicates underlying strength of an uptrend.

Hidden Bearish Divergence

- Forms when price is making a lower high (LH), but the MACD oscillator is showing a higher high (HH).

- Hidden bearish divergence occurs when there is a retracement in an uptrend.

MACD bearish divergence

- This setup confirms that a retracement move is complete. This diverging indicates underlying strength of a downtrend.