One of the great advantages of trading currencies is that the forex market is open 24 hours a day (from 5pm EST on Sunday until 4pm EST Friday). Economic data tends to be one of the most important catalysts for short-term movements in any market, but this is particularly true in the currency market, which responds not only to U.S. economic news, but also to news from around the world. With at least eight major currencies available for trading at most currency brokers and more than 17 derivative of them, there is always some piece of economic data slated for release that traders can use to inform the positions they take. Generally, no less than seven pieces of data are released daily from the eight major currencies or countries that are most closely followed. So for those who choose to trade news, there are plenty of opportunities. Here we look at which economic news releases are released when, which are most relevant to forex (FX) traders, and how traders can act on this market-moving data.

Which Currencies Should Be Your Focus?

The following are the eight major currencies:

1. U.S. dollar (USD)

2. Euro (EUR)

3. British pound (GBP)

4. Japanese yen (JPY)

5. Swiss franc (CHF)

6. Canadian dollar (CAD)

7. Australian dollar (AUD)

8. New Zealand dollar (NZD)

This is just a sample of some of the more liquid derivatives based on the currencies above:

1. EUR/USD

2. USD/JPY

3. AUD/USD

4. GBP/JPY

5. EUR/CHF

6. CHF/JPY

As you can see from these lists, the currencies that we can easily trade span the entire globe. This means that you can handpick the currencies and economic releases to which you pay particular attention. But, as a general rule, since the U.S. dollar is on the "other side" of 90% of all currency trades, U.S. economic releases tend to have the most pronounced impact on the market.

Trading news is harder than it may sound. Not only is the reported consensus figure important, but so are the whisper number and the revisions. Also, some releases are more important than others; this can be measured in terms of both the significance of the country releasing the data and the importance of the release in relation to the other pieces of data being released at the same time.

When Are News Releases Issued?

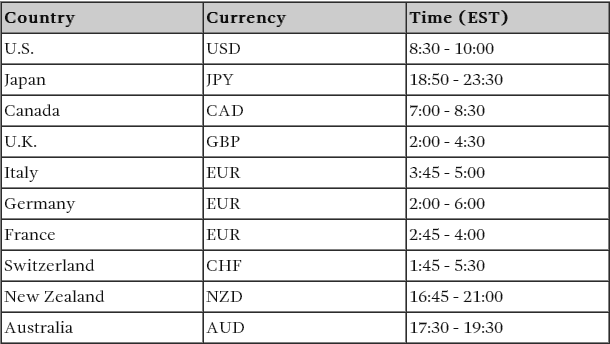

Figure 1 lists the approximate times (EST) at which the most important economic releases for each of the following countries are published. These are also the times at which you should be paying extra attention to the markets if you plan on trading news releases.

Figure 1: Times at which various countries release important economic news

What Are the Key Releases?

When trading news, you first have to know which releases are actually expected that week. Second, it is key for you to know which data is important. Generally speaking, these are the most important economic releases for any country:

1. Interest rate decision

2. Retail sales

3. Inflation (consumer price or producer price)

4. Unemployment

5. Industrial production

6. Business sentiment surveys

7. Consumer confidence surveys

8. Trade balance

9. Manufacturing sector surveys

Depending on the current state of the economy, the relative importance of these releases may change. For example, unemployment may be more important this month than trade or interest rate decisions. Therefore, it is important to keep on top of what the market is focusing on at the moment. (For more insight on these indicators, see Economic Indicators To Know.)

How Long Does the Effect Last?

According to a study by Martin D. D. Evans and Richard K. Lyons published in the Journal of International Money and Finance (2004), the market could still be absorbing or reacting to news releases hours, if not days, after they are released. The study found that the effect on returns generally occurs in the first or second day, but the impact does seem to linger until the fourth day. The impact on order flow, on the other hand, is still very pronounced on the third day and is still observable on the fourth day.

How Do I Actually Trade News?

The most common way to trade news is to look for a period of consolidation ahead of a big number and to just trade the breakout on the back of the number. This can be done on both a short-term intraday basis and a daily basis. Let's look at the chart in Figure 2 as an example. After a weak number in September, the market was holding its breath ahead of the October number, which was to be released to the public in November. In the 17 hours before the release, the EUR/USD was confined within a tight 30-pip trading range. For news traders, this would have provided a great opportunity to put on a breakout trade, especially since the likelihood of a sharp move at this time was extremely high.