Is it a Good Time to Get Long the Dollar versus the Japanese Yen?

US Dollar trades near range lows versus the Japanese Yen

A look at real FX volume indicator highlights key levels worth watching

We’re waiting for a drop towards bigger support

The Dollar is trading in a tiny range versus the Japanese Yen. Is it a good time to buy? These are the price levels we’re watching for potential trades.

USDJPY Coiling up For Next Big Move as Low Volume and Volatility Warn of Complacency

The USDJPY currently trades towards the bottom of its tiny trading range. In order to gauge whether a breakdown is possible we take a look at the most significant levels of trader interest—prices at which volume was highest.

Spikes in Volume Tell us Where Traders are Most Likely to Defend Support and Resistance

Our data shows that the biggest volume spikes in the past three months

occurred when the USDJPY traded to ¥100.80, 101.70, 102.15, 102.60, and

103.00. Why does this matter?

Put simply, these are the levels which traders have traded most

aggressively as the pair sticks to its narrow range. If there was

significant selling interest as the pair pulled back from ¥102.15, for

example, we might expect many of the same traders to sell once more if

price approaches that level.

It bears mention that there was no such spike in volume as the USDJPY

traded into multi-month lows near ¥101.20. We have to go back to the May

low at ¥100.80 to see a more significant jump in trading volume. All

the while, there are a number of important resistance levels just above

current price.

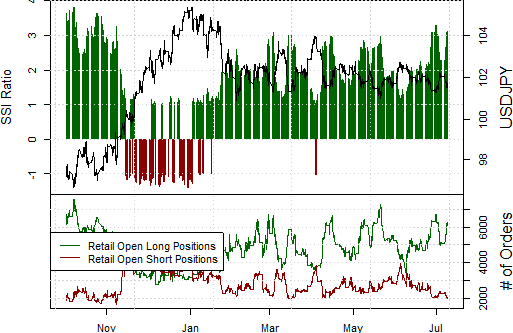

A closer look at what traders are holding shows that the vast majority

remain long the USDJPY. In fact our Retail FX Positioning chart (below)

shows that current levels of positioning have coincided with Dollar

bounces on a year-to-date basis. Does that mean we might buy the USDJPY

at current levels?

Retail FX Positions Consistent with Important Turns in USDJPY

One-sided positions suggest the pair is likely to trade higher, but

potential reward on the trade looks limited in comparison to potential

risk. According to our volume data, big support is at ¥100.80—currently

90 points from market price at 101.70. Important resistance starts at

¥102.15 which would put our first price target on a long position a mere

45 points away.

With twice as much risk as potential reward (90 versus 45), it seems

excessively risky to buy USDJPY at current levels. Instead we might look

to buy if price dips back towards the 100.80 lows with a target for

range highs.

The long-term consolidation pattern suggests that the USDJPY might break

significant price levels and could be worth a buy. Yet until that

happens we’ll look for range trading opportunities.