Five charts you should see before deciding oil is heading back to $100

In April oil has jumped 20 percent to settle at $57 a barrel, as market players considered expanding

violence in Yemen could disrupt supplies. The jump comes after the biggest drop since 2008, with crude dropping last month as low as $43.46 a barrel due to a price war between OPEC producers and US shale drillers.

However, before deciding that the prices are heading back to $100, look at the five charts Bloomberg has compiled.

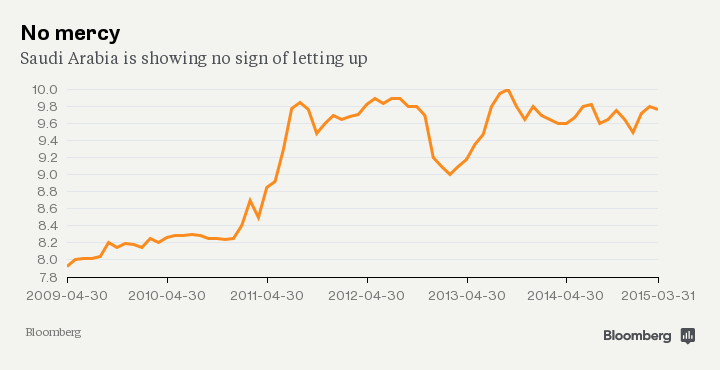

Saudi Arabia keeps on pumping

Instead of propping up prices, the Saudis decided in November to defend their market share, thus sending the market into a freefall, and they show no sign of changing course.

According to the data compiled by the International Energy Agency, Saudi Arabia's output was near all-time high in March. The Organization of Petroleum Exporting Countries next meets in June.

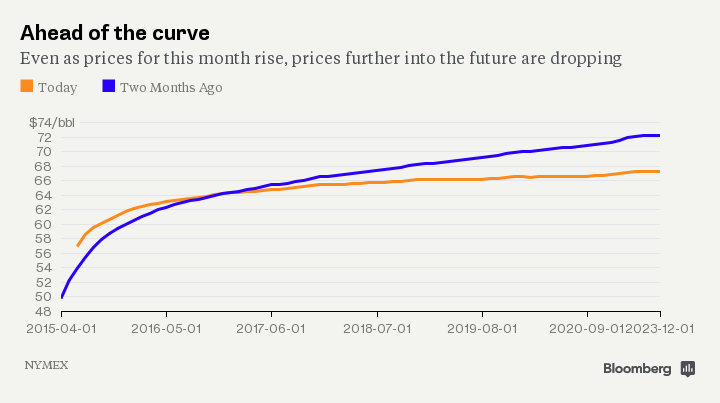

Long-dated futures are declining

Although prices rise for oil contracts due to be settled in the next few months, the price of oil is actually falling when delivery is taking place in several years.

For instance, two months ago, crude oil for delivery in January 2019 sold for $68.32 a barrel, according to New York Mercantile Exchange data. Monday, the same contract traded at $66.35.

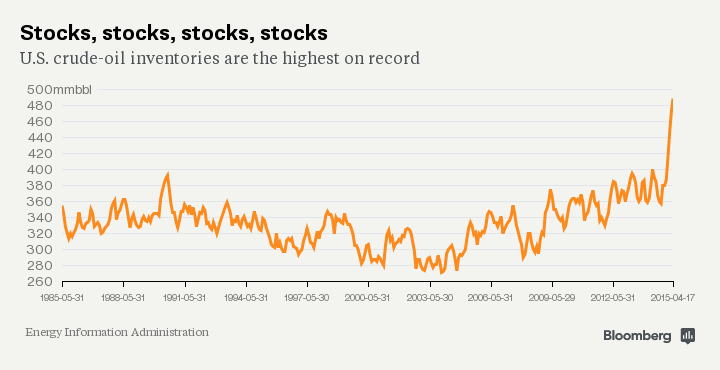

U.S. storage keeps most oil since 1982

The U.S. has almost 500 million barrels of crude oil in storage. That's by far the most oil in storage since record-keeping began in 1982. Supplies have grown because of surging domestic production and restrictions on most crude exports.

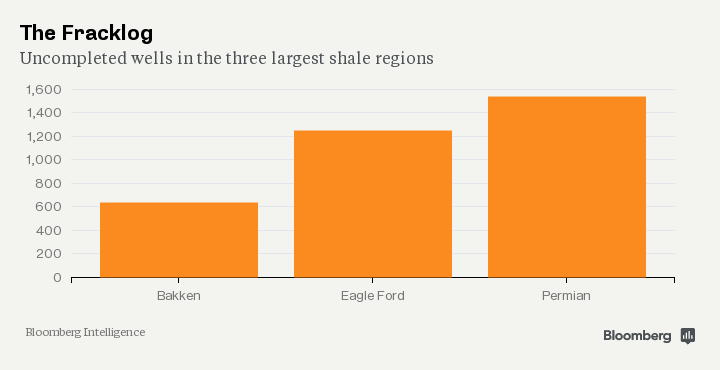

Fracklog

Companies are waiting for prices to recover before they start pumping after drilling already thousands of wells. That could quickly flood the market with fresh supplies, trimming the rally.

The three top-producing shale fields have more than 3,400 drilled but

uncompleted wells. There are more than 4,000 in oil-producing regions nationwide.

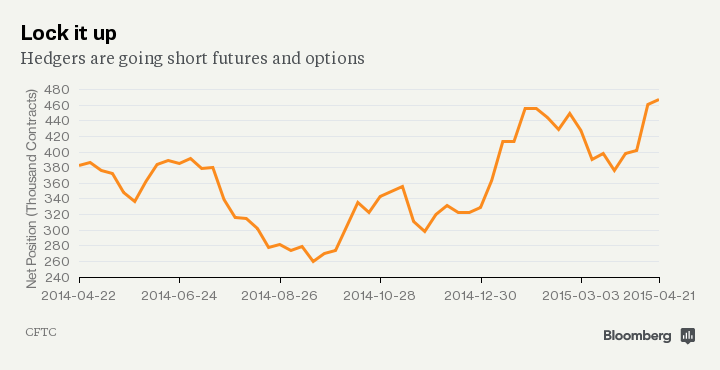

Industry participants lock in prices now for oil produced later

According to the data from the U.S. Commodity Futures Trading

Commission, producers, merchants and other industry participants are selling

futures and options contracts that will lock in future profits, ensuring

they can keep pumping. These short positions are the highest since

October 2011. That could be a sign of drillers locking in a future price

now because they might not get a better one.