The Scalpers Checklist - always identify market conditions prior to trading

Traders should have a checklist to consult prior to making any major trading decisions. These steps are critical for Forex scalpers as they often have to make these choices on a moment’s notice. To help with the process it can be helpful to keep a checklist and determine your options prior to approaching the market.

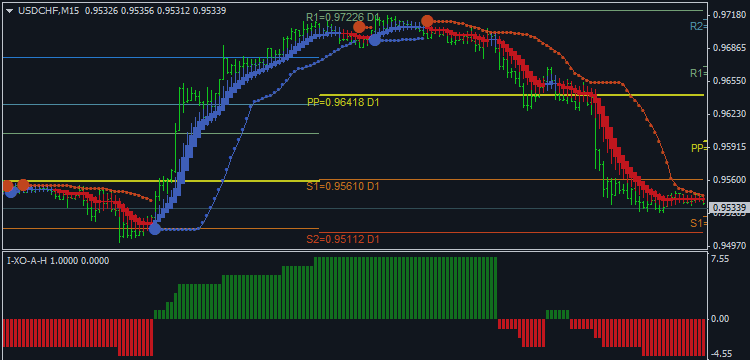

Identify Market Conditions

The first task assigned to day traders and scalpers is to identify market conditions. Is the market trending or ranging? Is the volatility of an asset low or high? These are both important questions that should be answered prior to entering into a new trade idea. Not only will this help Forex traders which currency pair to trade, but also help determine their strategy. Every scalper and day trader should check this off their list, prior to considering any market entries!

Choose a Strategy

Once market conditions are found, traders need to identify a strategy that is congruent with the market. If you are trading a trend, you will need to not only find market direction but also decide if you are going to trade a retracement, momentum or breakout strategy. In lack of a trend, traders again need to decide how to approach pricing patterns, support & resistance values, as well as potential breakouts. With so many strategies to choose from, it is worth taking your time and doing your due diligence prior to checking this off your scalping list.

Plan Your Entry

Next traders need to select how they are going to enter into the market. Typically traders need to first determine if they will trade with market orders or entry orders. Market orders allow you to trade immediately if conditions are met and you are immediately in front of your trading terminal. Entry orders can be used and will execute at a designated price even if you aren’t watching the market.

Manage Risk

This point of our check list goes beyond the simple placement of stop and limit orders. Scalpers must carefully consider how much they should risk on each trade. At this point specific questions should arise. How many pips are you risking per trade? What is your average profit target per trade? How does a stop order being executed equate to a loss on my account?

While no trader wants to take a loss it is paramount to determine these values prior to scalping. Once these values are set, you can mark this point off your checklist. Now all you have left is to hold yourself accountable to your trading decisions.