Trend following indicators were created to help traders trade currency

pairs that are trending up or trending down. We have all heard the

phrase “the trend is your friend.” These indicators can help point out

the direction of the trend and can tell us if a trend actually exists.

Moving Averages

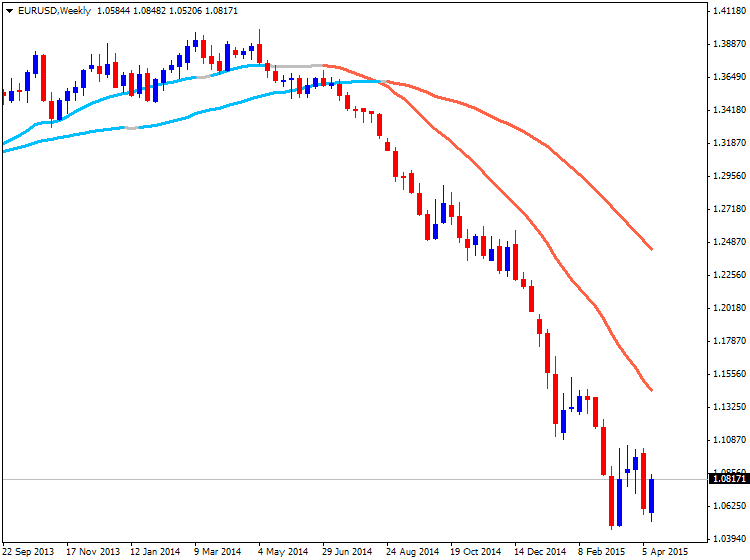

A Moving Average (MA for short) is a technical tool that averages a currency pair’s price over a period of time. The smoothing effect this has on the chart helps give a clearer indication on what direction the pair is moving either up, down, or sideways. There are a variety of moving averages to choose from. Simple Moving Averages and Exponential Moving Averages are by far the most popular.

Ichimoku

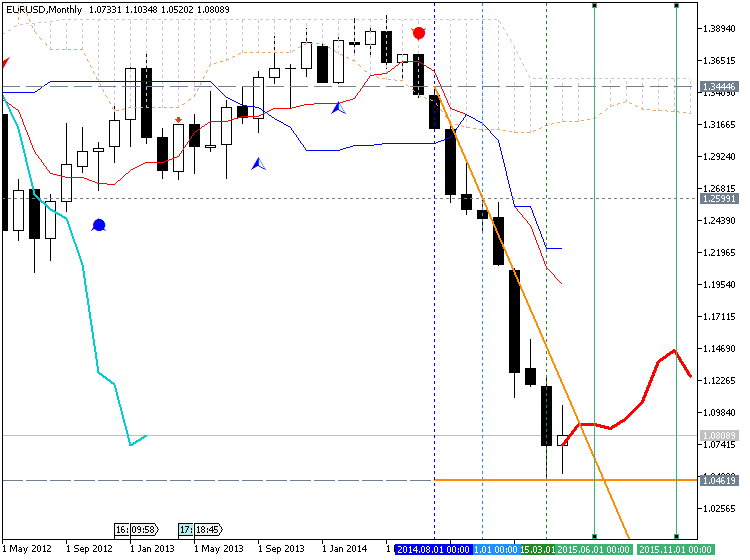

Ichimoku is a complicated looking trend assistant that turns out to be much simpler than it initially appears. This Japanese indicator was created to be a standalone indicator that shows current trends, displays support/resistance levels, and indicates when a trend has likely reversed. Ichimoku roughly translates to “one glance” since it is meant to be a quick way to see how price is behaving on a chart.

ADX

Moving Averages

A Moving Average (MA for short) is a technical tool that averages a currency pair’s price over a period of time. The smoothing effect this has on the chart helps give a clearer indication on what direction the pair is moving either up, down, or sideways. There are a variety of moving averages to choose from. Simple Moving Averages and Exponential Moving Averages are by far the most popular.

Ichimoku

Ichimoku is a complicated looking trend assistant that turns out to be much simpler than it initially appears. This Japanese indicator was created to be a standalone indicator that shows current trends, displays support/resistance levels, and indicates when a trend has likely reversed. Ichimoku roughly translates to “one glance” since it is meant to be a quick way to see how price is behaving on a chart.

ADX

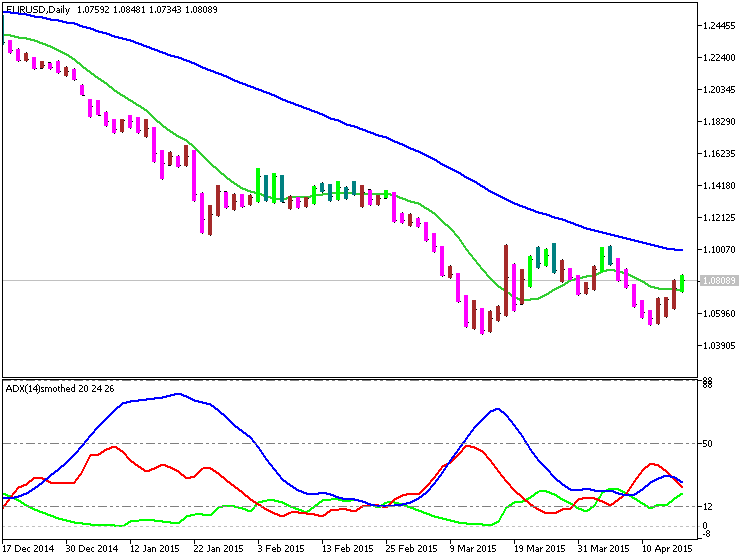

The Average Direction Index takes a different method when it comes to analyzing trends. It won’t tell you whether price is trending up or down, but it will tell you if price is trending or is ranging. This makes it the perfect filter for either a range or trend strategy by making sure you are trading based on current market conditions.

![[NEW and FREE] AI Chart Technical Analysis: Upload → Plan in seconds (MT4/MT5/eToro) [NEW and FREE] AI Chart Technical Analysis: Upload → Plan in seconds (MT4/MT5/eToro)](https://c.mql5.com/6/984/splash-preview-765177.png)