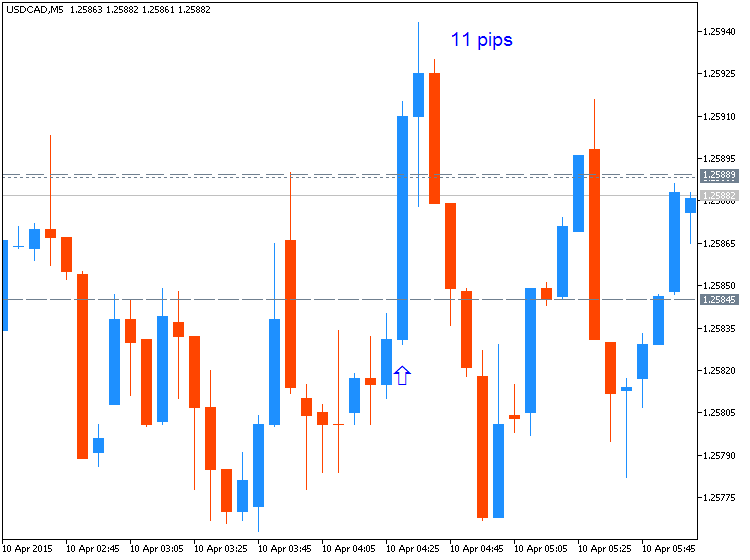

USDCAD Intra-Day Fundamentals - China Customer Price Index (CPI) and 11 pips price movement

- past data is 1.4%

- forecast data is 1.3%

- actual data is 1.4% according to the latest press release

if actual > forecast (or previous data) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to respond by raising interest rates.

==========

China CPI steadies, but sends mixed signals

“China kicked off economic reports for the month of March in decent

fashion, as CPI held steady at 1.4% beating consensus by a decimal and

PPI declines stopped accelerating for the first time in 8 months.”

“Sequentially,

CPI fell 0.5% after rising 1.2% in Feb, but YTD CPI edged up to 1.2%

from 1.1%. Non-food component was unchanged at 0.9%.”

“Analysts

are split on the implications of the latest inflation data - some see

the report as beginning of stabilization that would diminish the need

for PBoC to ease aggressively, while others do not see the release

sufficiently significant to alter the increasingly more regular easing

path.”

“Investors will monitor lending, M2 money supply, and Trade figures expected over the next few trading sessions.”

==========

USDCAD M5: 11 pips price movement by CNY - CPI news event

M5