0

1 380

Wilder suggests that divergence between an asset's price movement

and the RSI oscillator can signal a potential reversal. The reasoning is

that in these instances, directional momentum does not confirm price.

A bullish divergence forms when the underlying asset makes a lower low and RSI makes a higher low. RSI diverges from the bearish price action in that it shows strengthening momentum, indicating a potential upward reversal in price.

A bearish divergence forms when the underlying asset makes a higher high and RSI forms a lower high. RSI diverges from the bullish price action in that it shows weakening momentum, indicating a potential downward reversal in price.

As with overbought and oversold levels, divergences are more likely to give false signals in the context of a strong trend.

How to spot divergence

In order to spot divergence we look for the following:

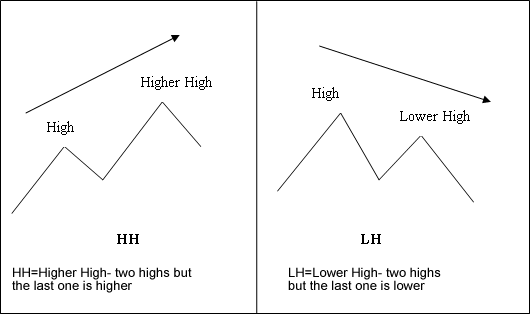

- HH=Higher High - two highs but the last one is higher

- LH= Lower High - two highs but the last one is lower

- HL=Higher Low - two lows but the last one is higher

- LL= Lower Low - two lows but the last one is lower

First let us look at the illustrations of these terms

There are two types of divergence:

- Classic

- Hidden