0

337

There are 4 types of MA:

- Simple moving average

- Exponential moving average

- Smoothed moving average

- Linear weighted moving average

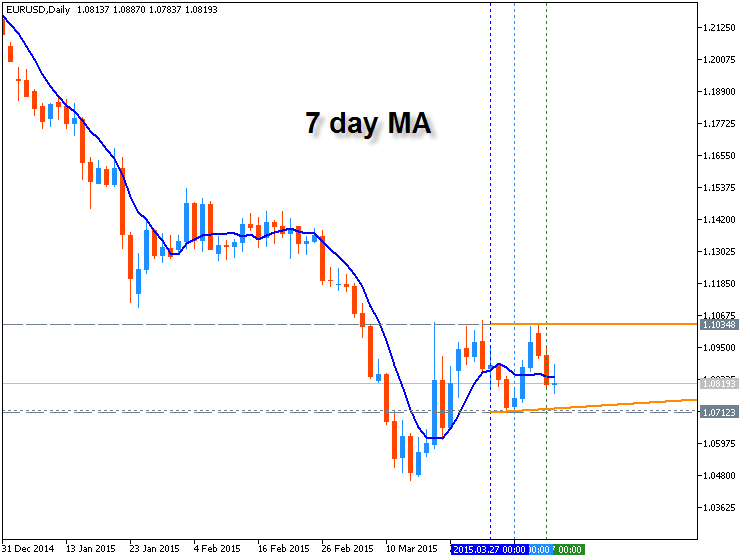

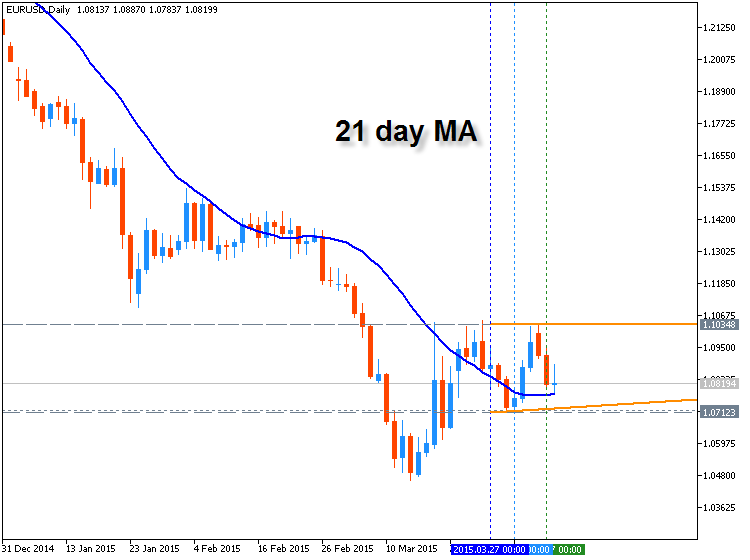

If another trader uses longer time periods then the MA will react much slower. For example, if traders use 14 day MA so it will react much slower.

The moving

averages can be used for various task, but it is suggested that they are

used with other technical indicators. The great thing about moving

averages is that they simplify data for the eyes.

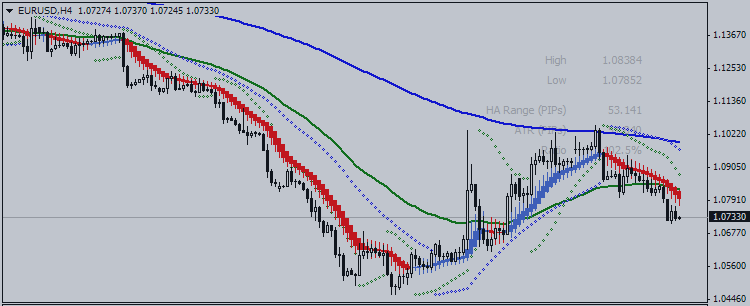

- Support - look for price reversing when it moves close to a longer term moving average line.

- Resistance - when the price comes close to the line of moving average, traders will sell in hopes of taking profits at the top of a natural resistance level.

- Crossover - Moving averages can be used as basic buy/sell

points by detecting crossovers when the moving averages line crosses

above and below the price bars

- Crossover on Moving Average Ribbons - When two different moving averages crossover one another, this can

signal a possible reversal.