Current trend

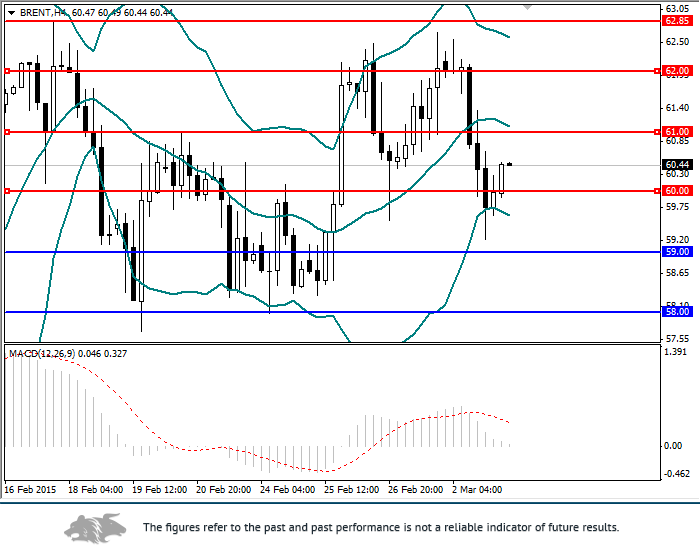

Brent crude oil grew substantially at the end of the last week due to aggravation of the geopolitical situation. Quotes rose above a level of $62, but Brent again failed to consolidate at that level owing to US increasing oil products stocks. Predictably, the rate reversed downwards at the beginning of the trading week, on Monday 2 March, and had dropped below $60/bbl by the end of the day.

The economic calendar does not foresee any macroeconomic releases today that could affect the GBP/USD rate.

Support and resistance

On H4 chart, the MACD histogram is located in the positive zone. Its volumes are reducing swiftly, signalling the continuation of the current downtrend. Bollinger bands are directed downwards, confirming the downtrend, but there is still a chance of short-term upward correction to a level of 61.00.

Support levels: 59.00, 58.00, 57.00.

Resistance levels: 60.00, 61.00, 62.00, 62.85.

Trading tips

A sell limit order may be placed at the level of 61.00 with the nearest target at 60.00. If the latter is broken down, Brent will head for a level of 59.00.