Hello Traders!

- The market for gold coins and bars in Europe is now twice as large as that of the United States, and similarly on par with those of China and India. In addition, the India Trade Ministry is said to be seeking to cut the gold import tax from 10 percent to 2 percent.

- With new global mined gold supply averaging around 258 tonnes per month, and with 255 tonnes of gold withdrawals from the Shanghai Gold Exchange in January, China is effectively consuming all of the world’s new mined supply.

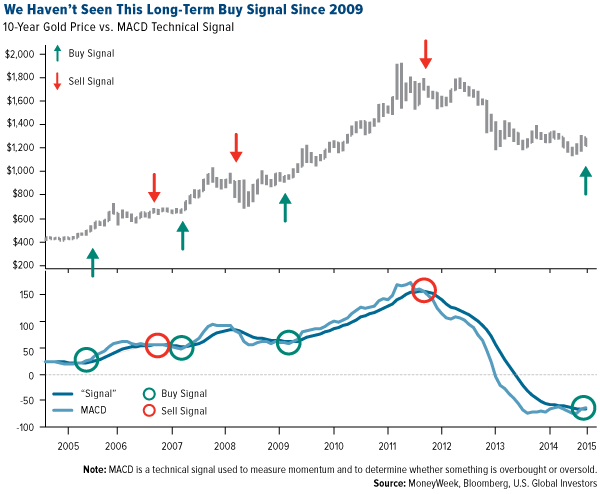

- In 2014 governments added 477.2 metric tonnes to their reserves, the second-biggest increase in 50 years and 17 percent more than the previous year. Furthermore, central banks have added to gold reserves for the past five years, representing a reversal from two decades of selling. For investors considering adding bullion to their portfolio, gold just triggered this long-term buy signal (only the fourth one to show up in the past 10 years as illustrated by the technical chart shown below). The prior signals have come in 2005, 2007 and 2009, and each time gold rallied thereafter.

But ,Keep in mind that : Gold traders are bearish for the first time in three months on concerns about a stronger dollar and weakening demand from China’s slowing economy.

Always Remember : The market is not an ATM machine , you have to manage your risk actively. $Study.