Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - S&P 500 Drops Most in Nearly 4 Months to Test 2000

US DOLLAR TECHNICAL ANALYSIS

Prices may be readying to turn

lower after producing a bearish Evening Star candlestick pattern. A

daily close below the intersection of the 14.6% Fibonacci retracement

and a rising trend line at 11725 exposes the 23.6% level at 11640.

S&P 500 TECHNICAL ANALYSIS

Prices declined as expected

after putting in a bearish Evening Star candlestick pattern. A daily

close below 1996.10, the intersection of the 61.8% Fibonacci expansion

and a rising trend line, exposes the 76.4% level at 1979.10.

GOLD TECHNICAL ANALYSIS

Prices continue to consolidate after

finding resistance above the $1300/oz figure. A daily close below the

23.6% Fibonacci retracement at 1274.30 exposes the 1253.77-55.20 area

marked by the October 21 high and the 38.2% level. Alternatively, a push

above the 14.6% Fib expansion at 1292.73 targets the 23.6% threshold at

1305.39.

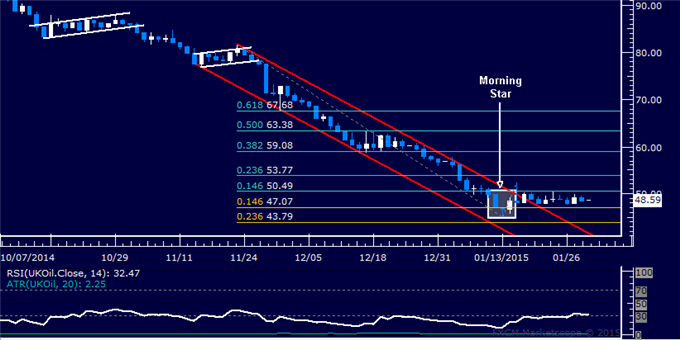

CRUDE OIL TECHNICAL ANALYSIS

Prices are stalling having

attempted to recover as expected. A daily close above the 14.6%

Fibonacci retracement at 50.49 exposes the 23.6% level at 53.77.

Alternatively, a reversal below the 14.6% Fib expansion at 47.07 targets

the 23.6% threshold at 43.79.