Dear Friends, Traders, and Brokers.

It would be great if MetaQuotes will require from all registered brokers to sign on an agreement with MetaQuotes to enable the MetaTrader Servers to Signal Traders on their MetaTrader platform of the total amount of funds deposited on the server is coming any close to the 30% margin call. That way Traders will know when to remove their funds from the broker before it goes bankrupt.

Thank you for reading and for your support.

Currency Brokers Fall Over Like Dominoes After SNB Decison On Swiss Franc

You might think the sight of currency brokers falling over into bankruptcy in their droves as a result of the Swiss National Bank’s decision to lift the cap in the value of the Swiss Franc is a bad idea. You could also think of it as a very welcome intervention into a part of the market where individual investors really have very little business trying to play. And that second is almost certainly the correct view to take as well. No doubt there will be all sorts of calls for increased regulation as a result of these recent events but as ever, markets can move quite a lot faster than those regulators. No one’s going to be offering the conditions that led to these events anytime soon so the matter’s almost certainly pretty much done with with or without the regulation.

Here’s what’s been happening: FXCM Inc., which handled a record $1.4 trillion of trades by individuals last quarter, said clients owe $225 million on their accounts after the Swiss National Bank’s decision to abandon the franc’s cap against the euro roiled markets worldwide. Global Brokers NZ Ltd. said losses from the franc’s surge are forcing it to shut down. IG Group Holdings Plc estimated an impact of as much as 30 million British pounds ($45.5 million) and Swissquote Group Holdings SA set aside 25 million francs ($28.4 million). “I would be astonished if we did not see more casualties,” Nick Parsons, the London-based head of research for the U.K. and Europe at National Australia Bank Ltd., said by phone from Sydney. “This was a 180-degree about turn by the SNB. People feel hurt and betrayed.”

In the U.K., retail broker Alpari Ltd. said it had entered insolvency. “Where a client cannot cover this loss, it is passed on to us. This has forced Alpari (UK) Limited to confirm…that it has entered into insolvency,” the firm said. Fellow U.K. broker IG Group PLC said it was facing a negative impact of up to £30 million ($45.7 million) after the “sudden and extreme movement” in the franc.

Here’s what the basic set up was. Currencies generally don’t move all that much but they do tend to move a little bit all the time. This obviously attracts people who like to bet on things. But the movements are a few basis points (one basis point is 0.01%) a day. So, if you’ve got $100 in the market and you also manage to bet the right way then you might make two or three cents on a day. That’s not really very exciting.

So people go out and play in these markets with tens and hundreds of thousands at a time. But of course most people don’t actually have tens or hundreds of thousands to day trade a market, even something like foreign exchange. So, the brokers would allow people to play with leverage. And what leverage too: ratios of 100:1 were entirely common and there were some shops that allowed 500:1. So, you put in your $100 and you’re allowed to go trade $50,000 of currency. OK, OK, this is all very silly but it’s not actually illegal.

Individual investors really just shouldn’t be playing in these sorts of markets in this sort of manner. That doesn’t mean there should be a law against it but still, not an intelligent thing to be doing. And these currency brokers could see that. The general assumption was and has been for some time that these individual investors are going to, over time, lose their money. This, added to one other factor, ramps up the dangers. That other factor being that the brokers are (at 100:1 leverage) charging only a 1% deposit. But if they want to aggregate some of their exposure and lay it off out into the general market then they’re likely to have to pay a 3% deposit themselves. So the temptation (well, as it turns out, the reality) is that all of this risk is kept within the firm.

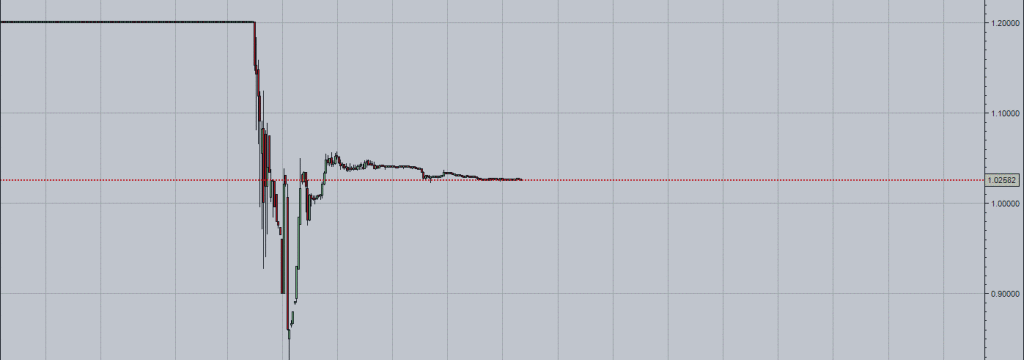

On the normal day to day basis that’s just fine. Prices move a few basis points, some win, some lose, the broker keeps his fees and gradually makes money as the investors lose theirs in aggregate. But of course all know that prices can move more than just those few basis points. So there’s things like stop loss orders in place. Say prices move by 100 basis points (recall, that’s 1%). Well, at that point the currency broker themselves are going to start having exposure. Because they’re brokered the deal, they’ve got to pay the winner but that loser is already out of money at that magnitude of price movement. So, to protect themselves when that sort of thing happens the brokers insist on those stop losses. Your deposit vanishes they close our your deal in order to protect themselves. But watch what happens when prices move 30% almost instantaneously, as they did yesterday on the CHF/EUR rate.

Those 1% stop losses can’t in fact be brought into play because there’s no market at all at those intermediate prices. We’ve had a leap from one price to another, not a move through the intermediate ones. And all of those on the wrong side of the CHF/EUR are 3,000 basis points out of the money while they only had 100 basis points on deposit. But the winners (of which there will be an equal number, must be, for every buyer there is a seller and vice versa) will be expecting their nice fat 3,000 basis points payouts and who has to come up with that? The currency broking platform in the middle. Sure, maybe there’s the possibility of chasing the losers for their money down the road but someone’s got to pay out now to maintain the market. The result? Bankruptcy, of course. As I said at the top this isn’t really a game that individual investors should have been playing. And if regulators had noted this and brought in rules to stop it (not that I think they should have, but just if they had) then I might have more respect for them.

They didn’t: but undoubtedly there will be calls for them to do so now. All of which is a little late, stable door and bolted horse sort of thing. Because people just aren’t going to be offering individual investors 500x leverage to day trade foreign exchange in the near future. The market has already, in its rather cut-throat and bloody manner, solved that little problem. Those who did so have gone bust and those who were thinking of doing so now won’t. My latest book is “23 Things We Are Telling You About Capitalism” At Amazon or Amazon UK. A critical (highly critical) re-appraisal of Ha Joon Chang’s “23 Things They Don’t Tell You About Capitalism”.