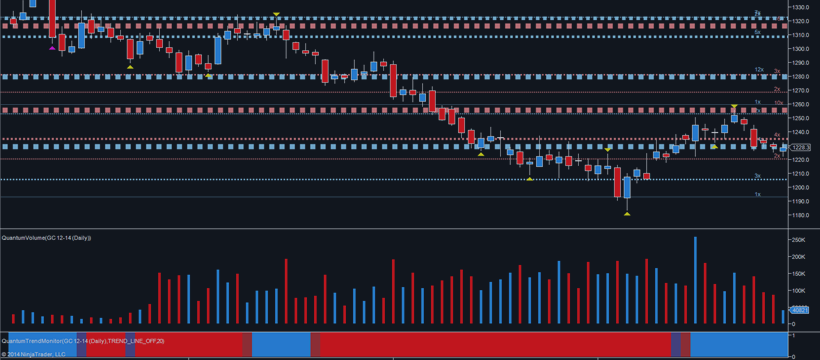

The Dollar and Euro gold price charts above show that gold was a rather stable asset class which is the baseline going into 2015. Ronald Stoeferle’s outlook for gold in 2015 is based on a continuation of that trend. It would not be realistic to expect a major move higher in the first half of 2015. Why? Because the current monetary and economic environment, characterized by a rise in negative real rates and a weakening of inflation momentum, is not very gold friendly.

The next chart shows negative real rates in blue and the gold price in gold. Since 2001, 56% of months had negative real rates. The level of interest rates has mostly determined the steepness of the gold price change. Real rates have been rising since 2011, not coincidentally the top of the gold price. Notice also on the chart how real rates are still in negative territory which suggests that the secular bull market is not over yet. It seems that the correction in the price of gold has reflected a lower level of real interest rate change.

This brings up the question whether we could potentially see positive real rates in 2015 driving gold into a secular bear market? Although nobody knows for sure, it seems an extremely unlikely scenario. First, try to imagine what would happen with the debt servicing cost if rates would rise. Second, with worsening results in the last earnings season(s), the effect of rising rates on corporate bonds would be very destructive. Third, the effect on the real estate market would be slightly devastating. Those are fundamental reasons to believe that the ongoing correction is not secular in nature.

The rate of inflation is slowing down which is, in simple terms, disinflationary. It is not so much the absolute rate of inflation that is relevant for the gold price, but rather the rate of change of inflation. Rising inflation rates generally mean that the environment for the gold price is positive, while falling rates of inflation (= disinflation) indicate the environment is negative. The next three charts set the expectation for the first months of 2015.

The gold to silver ratio keeps on rising, which points as well to

disinflation. Expect this trend to continue in the coming months.

Meantime, we know for sure that monetary policy makers will continue to

be the key trendsetters for the markets, including precious metals. Who

believes that central planners have fixed all issues and that 2015 will

go smooth economically? Probably central planners themselves hold that

belief, as some of them are already starting a deleveraging process.