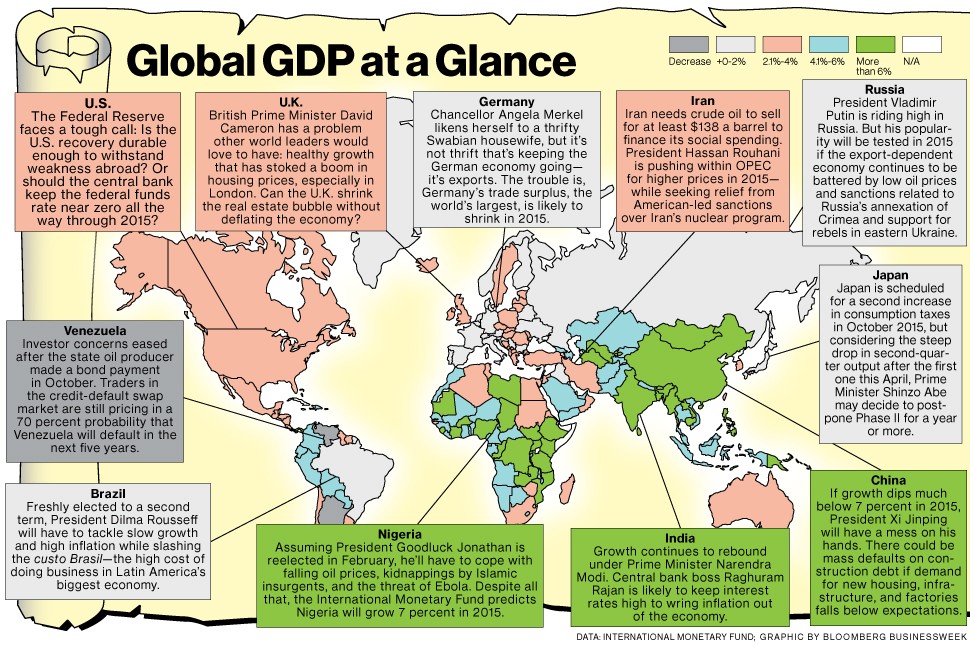

The map gives a snapshot of what’s ahead, based on the latest IMF forecast. South America is a mess, with Argentina and Venezuela leading the losers’ parade and Brazil not far behind. Russia and Western Europe are weak. All three economies of North America are looking pretty solid. The strongest growth is projected to be in South and East Asia as well as much of Africa, which is starting from a low base. Then there’s Greenland, which is … large.

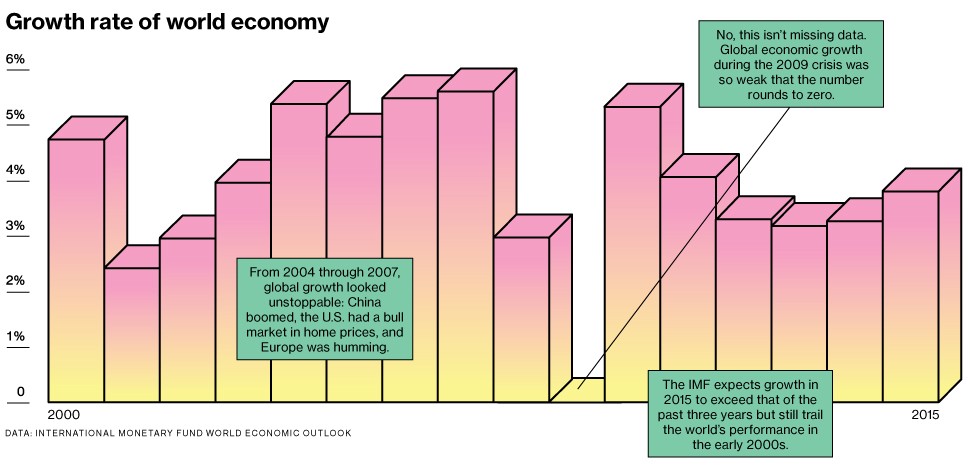

That’s led the IMF to reduce its forecast for 2015 global growth to 3.2 percent. It projects 3.1 percent growth for the U.S. next year, just 1.3 percent in the euro area, and 0.8 percent for Japan. China’s projected 7.1 percent growth, high compared with other nations’, would be the country’s lowest in 15 years. China isn’t geared for such a slowdown: Indebted investors such as property developers could default on a large scale if expansion comes in much below their expectations. The disparity in growth rates among the big four economies—the U.S., China, Japan, and the euro zone—was what Treasury Secretary Jacob Lew was referring to in October when he told Bloomberg, “You need all four wheels to be moving, or it isn’t going to be a good ride.”

Some things about 2015 are known, such as the continued warming of the

planet. Others are unimportant, like who wins the Super Bowl on Feb. 1

in Phoenix. (Sorry, football fans.) Keep an eye on things that are

unknown and important: Will Russia’s and China’s clashes with their

neighbors escalate into armed conflict? Will the Ebola epidemic break

out of West Africa on a large scale? Will China snuff out Hong Kong’s

democracy movement? Will British elections in May increase pressure on

the United Kingdom to drop out of the European Union? Will one of the

conflicts in the Middle East boil over? Any one of those could make 2015

a very ugly year.

The oil boom is a victory for drilling technology, much of which was

invented in the U.S. and is being deployed worldwide. That’s an example

of an important theme for 2015: Business investment spurred by

innovation may rescue the world from its protracted slump. Consumers are

still having a hard time paying down debt because their

inflation-adjusted incomes have fallen since the 2007-09 recession.

Business is in a better position to lead the recovery. Companies are

sitting on record amounts of cash because, with demand weak, they don’t

feel any pressure to update their plants, equipment, and software. Great

new technologies could set off a burst of capital spending by

convincing CEOs they must have the next new thing to get ahead of the

competition or avoid falling behind it.

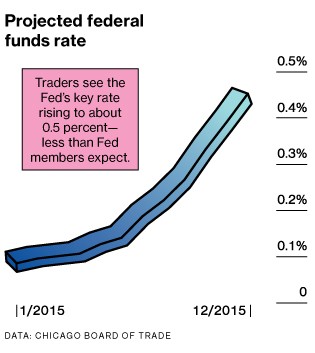

For the U.S. economy, the most critical unknown is whether 2015 will be the year the Federal Reserve finally begins to raise the federal funds rate, which it has locked at zero to 0.25 percent since the end of 2008. The lowest funds rate in history was perceived as an emergency measure during the financial crisis, but the economy still hasn’t shown that it can thrive without it. Critics say that cheap money is inflating asset bubbles and that the unemployment rate—5.9 percent in September—is as low as it can get without generating dangerous wage inflation.

The median forecast of the members of the rate-setting Federal Open Market Committee is for the funds rate to reach 1.25 percent to 1.5 percent by the end of 2015. Traders in the futures market are skeptical. They’re collectively betting that the funds rate will be only about 0.5 percent by then. That’s either a vote of no confidence in the U.S. economic recovery or a sign that traders think Fed Chair Janet Yellen is a dove who will keep rates low even after the economy gains strength, or maybe a little of both.

China is suffering its own brand of deflation. Wholesale prices have fallen every month since April 2012. Although President Xi Jinping has vowed to promote consumer-led growth, which would please the public by raising living standards, his efforts have fallen short. Business investment accounted for 49 percent of GDP last year, up from 35 percent in 2000, according to World Bank data. So much spending on plants and equipment leads to excess production capacity, which encourages price slashing that destroys profitability.