Price Pattern Analysis: Gold Breaks Five-Month Down Trend, S&P 500 May Have Formed a Double Top Below 2100 Figure

US DOLLAR TECHNICAL ANALYSIS

Prices may be preparing for a

pullback having put in a bearish Evening Star candlestick pattern below a

five-year high. A daily close below the 14.6% Fibonacci retracement at

11434 exposes the 23.6% level at 11379.

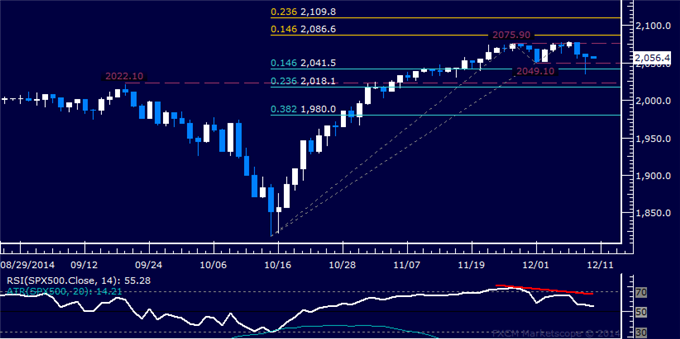

S&P 500 TECHNICAL ANALYSIS

Prices began to turn lower as

expected. A drop below the 2041.50-49.10 area marked by the 14.6%

Fibonacci retracement and the December 1 low exposes the 2018.10-22.10

zone (23.6% level, September 19 high).

GOLD TECHNICAL ANALYSIS

Prices overcome resistance at a falling

trend line set from early July, exposing the 50% Fibonacci retracement

at 1237.59. A break above this barrier on a daily closing basis exposes

the 61.8% level at 1262.96.

CRUDE OIL TECHNICAL ANALYSIS

Prices paused to consolidate

losses after five consecutive days of downward momentum. A break below

the 50% Fibonacci expansion at 65.96 exposes the 61.8% level at 64.30.