IzaTrade: RESULTS OF THE LAST FORECAST AND FORECAST FOR NEXT WEEK (24-28.11.2014)

Dear friends and readers,

As a rule, today’s forecast will contain information about how my last forecast worked out and forecast for the coming week (24-28.11.2014).

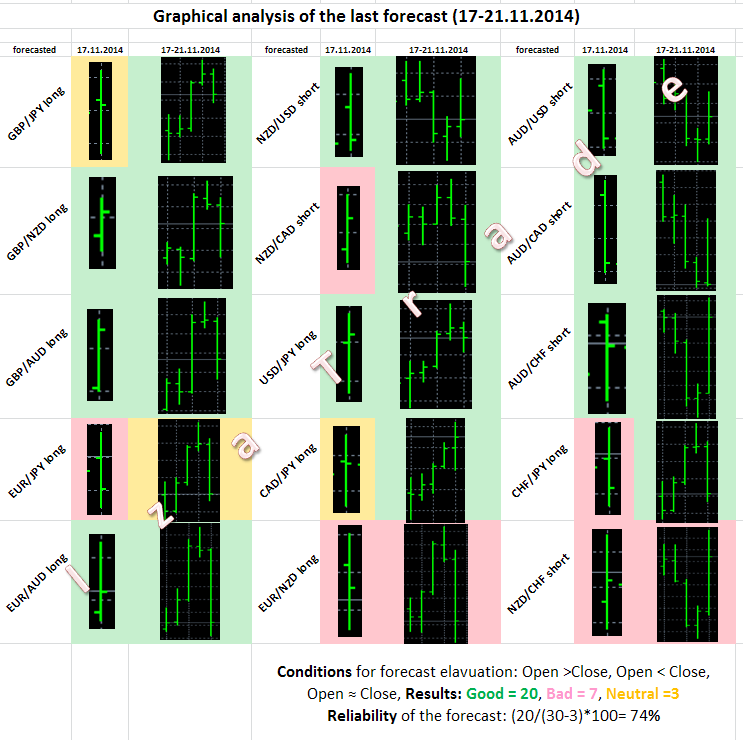

Results of the last forecast

The last forecast had worked for 74% (good). USD showed its strength one more time, especially against currencies in the strong currencies list.

Graphical analysis of the last forecast is given below for better understanding.

Forecast for the beginning of next week with the prospect for the end of week (28.11.2014г.)

Explanations: for determining of the strength/weakness of currencies the scale with values from -7 up to +7 will be used. Currencies with values from +1 up to +7 will be considered as strong currencies, and currencies with values from -1 up to -7 will be weak. Values with 0 are a neutral, and currency with 0 can easily move one of the both lists of weak currencies or strong currencies.

Strong currencies

USD dollar (+4) is still a leader, Britain pound (+4) has almost the same strength as USD . Swiss franc (+2) and Canadian dollar (+2) also in the strong currencies list too.

Weak currencies

Australian dollar is still keeping its position with a weakness value of -7. New Zealand Dollar (-3) and Euro (-2) are also in the weak currencies list too.

Japanese yen with value 0 is out of the both lists. And it is not recommends to trade it before determination of the direction. It is possible we will obtain information about changes.

Summary and recommendations for trading

Taking into account abovementioned, we can make a logical conclusion from above-mentioned, and to consider buying strong currencies and selling weak currencies by personal sympathy and understanding price fluctuation of some currency pairs.

Recommendations for the opening and closing positions

In the entering into the market it is appropriate to keep profit/loss ratio not less than 2/1 and entering after correction of main movements (of trend). For this purposes, Fibonacci levels, indicators and trend lines can be used.

Trading in Forex is risky, and author has no responsibilities for potential profit/losses based on this forecast.

It is prohibited to republish current forecast without using a references or including information in the text of materials.

Thank you for your attention.

Have profitable trades,