EUR/USD touched its lowest level of the year on Wednesday before rebounding off the 127% extension of the June/July advance near 1.3455

Our near-term trend bias is lower in the rate while below 1.3550

A daily close under 1.3455 is needed to confirm a broader move lower

A cycle turn window is eyed later this week

A move back over 1.3550 would turn us positive on the euro

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | 1.3405 | 1.3455 | 1.3470 | 1.3550 | 1.3590 |

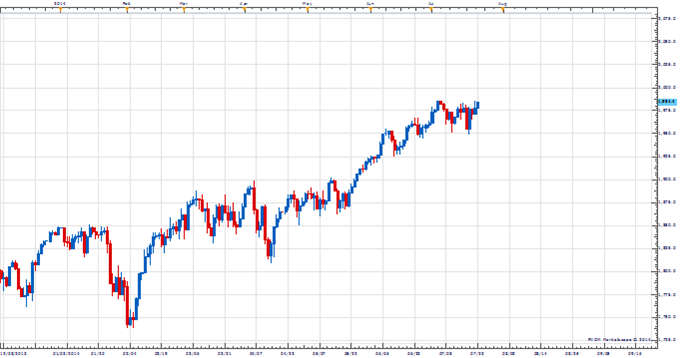

US equity markets underwent a hiccup last week (if you can even call it that) around the mid-month cyclical turn window we highlighted. Since then the S&P 500 has managed to punch through to a new all-time high while the Dow is dangerously close. All we can say is the resilience of the indices is quite remarkable - especially when taking into account some of the extremes in sentiment we have witnessed recently. The action of the past few days obviously puts our favored scenario of a multi-week/month correction into serious doubt, but we would like to give it just a little more time as a loose interpretation of the cycles has the window for a turn extending as far as the second half of this week. In the S&P 500 key resistance remains between 1989 and 2006 and the top end of this zone really needs to be overcome to signal that the trend is resuming in earnest.