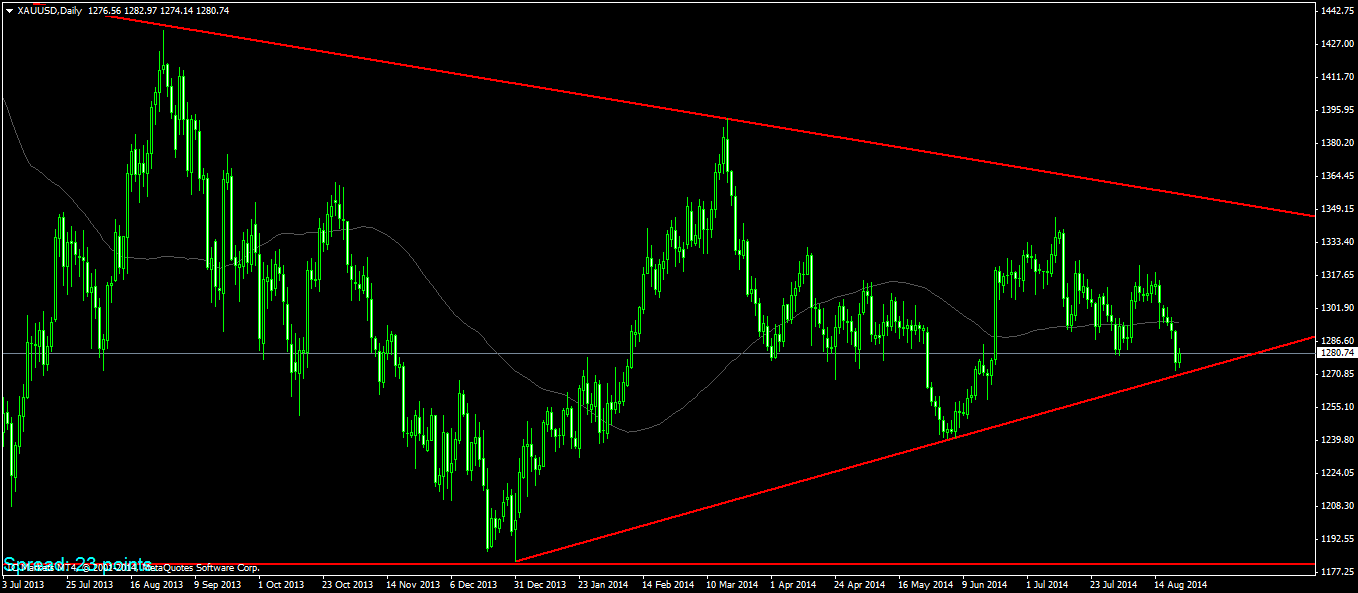

Observing XAUUSD, the equivalent of gold, it looks like this pair is still wedging. However, it will be a long time before we see some real consolidation going on here. Gold closed higher for once after 5 days, or a week, of selling. Not only that, it may be rebounding from the lower wedge line or trend-line early.

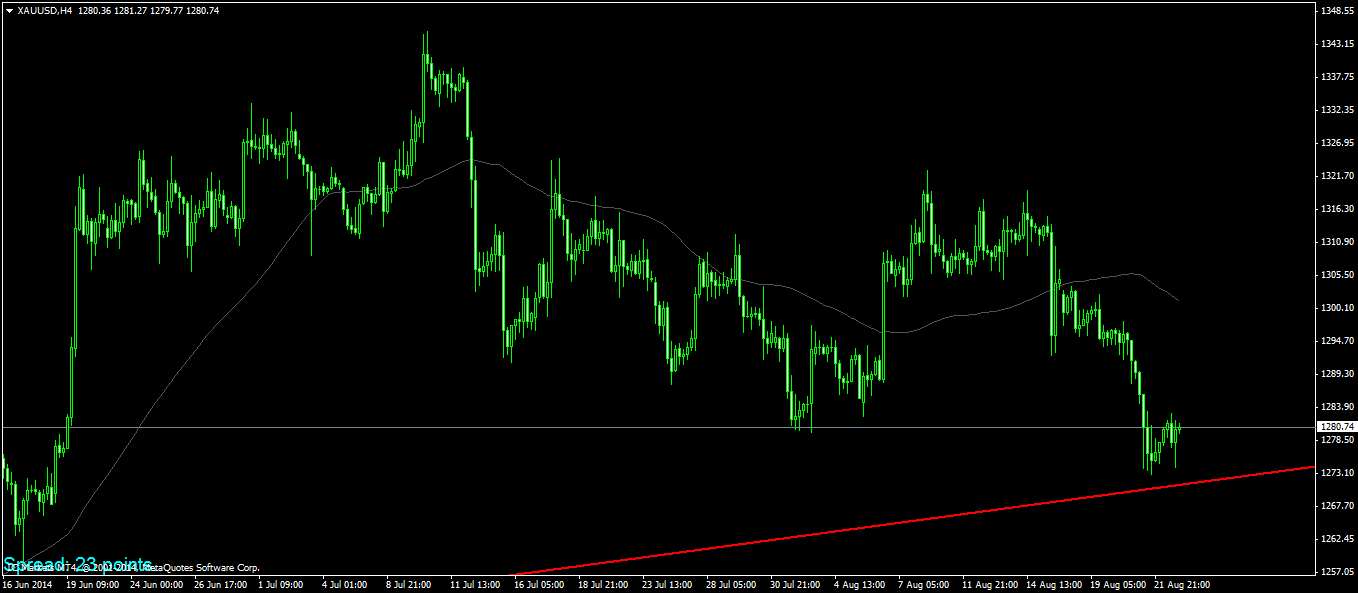

Interesting to note is the 4-hour chart actually. The last seven hours shows signs of strong buying on Monday's open.

Interesting to note is the 4-hour chart actually. The last seven hours shows signs of strong buying on Monday's open.

After the original fall, the price made bounce up followed by a lower close. Right after the lower close was strong selling, which turned into strong buying. This can be observed by the lower tail of the candle along with the smaller upper tail. Not much movement in the last four hours or last bar as the market was closing off. This is a higher risk trade to scalp counter trend. I say counter trend because the daily trend-line has not been tested yet. It is not enough to call it a bounce back from the trend-line after such short notice. We need to see at least another higher close before making any decisions. Right now, gold is a potential buy. You may pair it up with a momentum indicator of your choice to confirm this set-up. If you take a look at your 15 minute time frame, this pair already crossed the 100-period moving average. This can be treated as the first indication of a possible reversal.