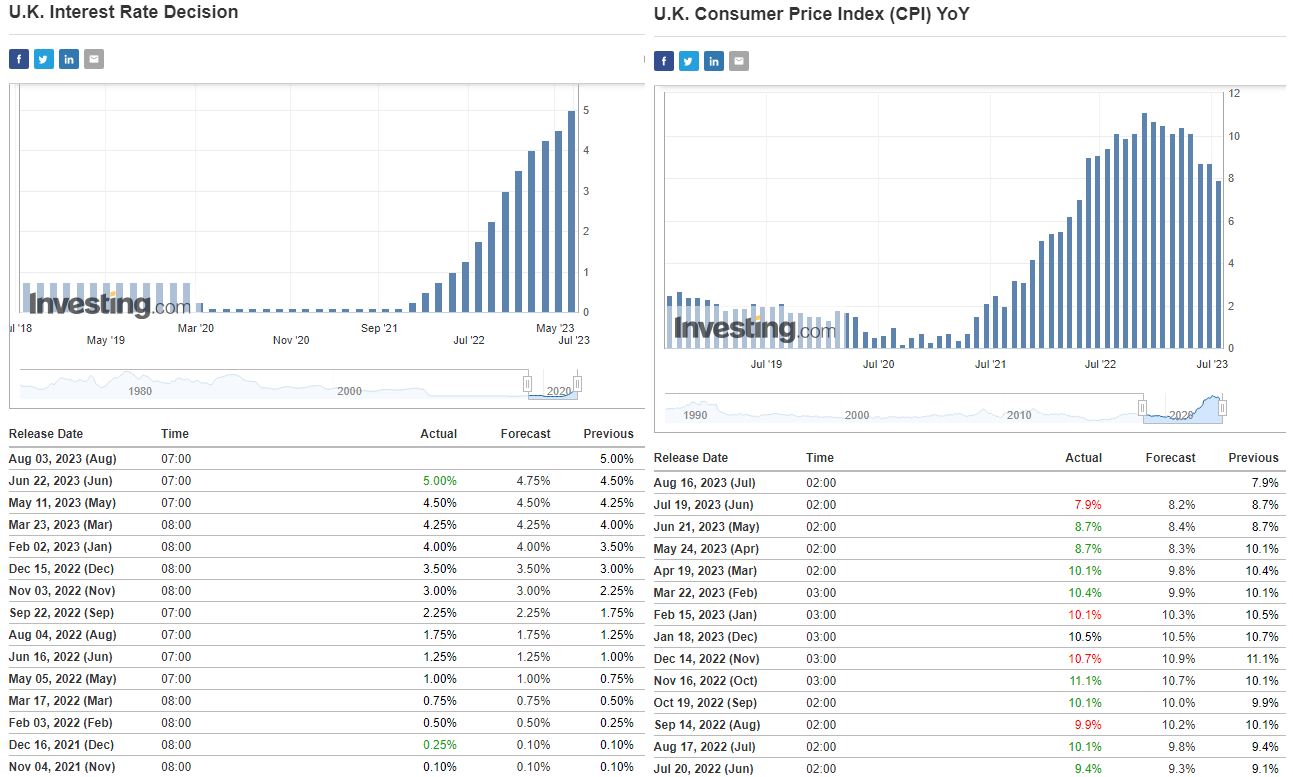

Inflation in the UK is slowing down. However, it remains the highest among all developed countries. Thus, from the report of the Office for National Statistics, published on July 19, it follows that annual inflation in the UK in June fell to 7.9% (stronger than the forecast of 8.2% and significantly lower than the May value of 8.7%). The core CPI (excluding food and energy prices) fell in June to 6.9% from 7.1% in May, the PPI - by -3.1% compared to the May value of +0.4%, to -2.7% (in annual terms).

This is a good sign, however, the British PMI indices are also showing negative dynamics, indicating a slowdown in business activity.

Thus, in July, the manufacturing PMI fell to 45.3 points (from 46.5, 47.1, 47.8, 47.9, 49.3 earlier), and a similar preliminary indicator for the services sector - to 51.5 points (from 53.7, 55.2, 55.9, 52.9, 53.5 before).

A recent report on the state of the British economy signals the nearness of a short-term recession: the country's GDP fell by -0.1% in May (after rising by +0.2% a month earlier and falling by -0.3% in March) and by -0 .4% in annual terms. At the same time, the volume of industrial production corrected by -0.6% (against -0.2% in April).

Under these conditions, the leaders of the Bank of England at a meeting on Thursday may prefer a pause in the cycle of tightening monetary policy. So far, economists are forecasting another interest rate hike of +0.25% to 5.25%. However, what this decision will be in reality remains an intrigue.

Many economists believe that the Bank of England could raise the interest rate to 5.50% or even to 6.00% if inflation remains high. And buyers of the pound can still count on support from the Bank of England, but until the economy begins to show more clear signs of a slowdown, and the Bank of England does not put the cycle of raising interest rates on pause.

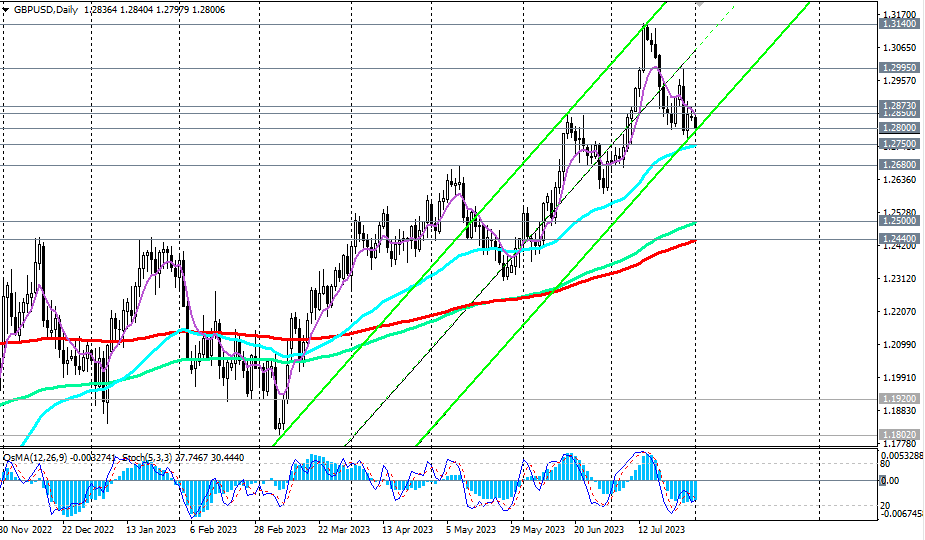

As long as the medium-term upward dynamics persists (above the key support levels of 1.2500, 1.2440), the current decline in GBP/USD can still be considered as a correction, up to the important support level of 1.2750.

Breakdown of the important long-term support level 1.2680 may signal the beginning of a return to the long-term downtrend. In this case, the breakdown of the key medium-term support levels 1.2500, 1.2440 will confirm this return.

In an alternative scenario, a signal for purchases will be a breakdown of important short-term resistance levels at 1.2850, 1.2873 with the nearest target at the local resistance level of 1.3000.

Support levels: 1.2800, 1.2750, 1.2700, 1.2680, 1.2600, 1.2500, 1.2440

Resistance levels: 1.2850, 1.2873, 1.2900, 1.3000, 1.3100, 1.3140, 1.3250, 1.3300, 1.3860, 1.3900, 1.4300

*) see also

- “Technical Analysis and Trading scenarios" - https://t.me/traderfxcrypto

- chanel FXCryptoTrader - https://www.mql5.com/en/channels/fxcryptotrader