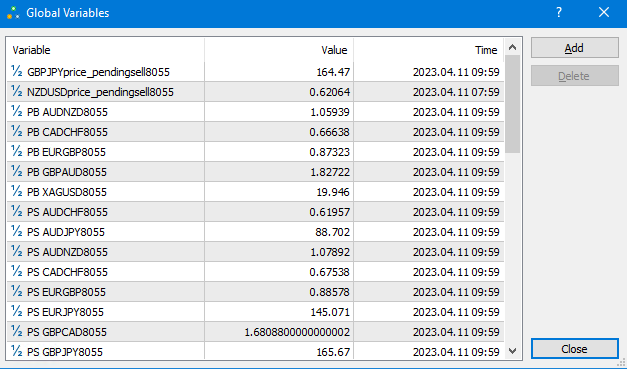

1. Press F3 to check pending order

2. do trend analysis for GBPJPY,NZDUSD adn USDCAD. In this example, after doing a trend analysis, I don't want to trade NZDUSD because the price movement hasn't really touched the extreme high to sell, so the profit potential is small, and there is a possibility of prolonged floating.

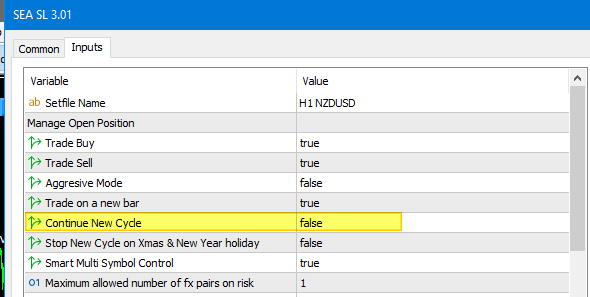

3. deactivate the fx pair that you don't want to trade by set the continue new cycle = false

but if after taking these preventive actions it turns out that there are still bad trades, then i do this :

here's my simple strategy to handle drawdown:

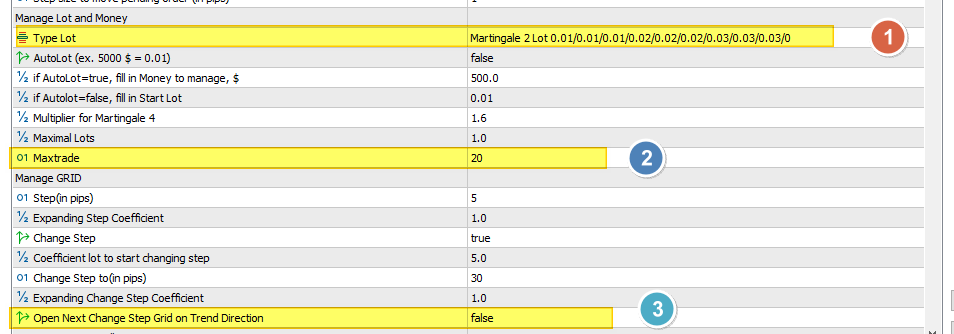

3. Set Open Next Change Step Grid on Trend Direction = true so that EA is more selective in opening the next position

Tools that I usually use:

I do an analysis of fx pairs that may be traded and may not be traded almost every day and I use a tool to filter out pairs from opening new trades.

I made trendline trade panel for semi auto trade to practice analytical skills on the backtester.

I realized that humans are better at observing trend movements than automated software, this made me in the early stages of starting to learn coding, I tried to create semi-automatic software to train the ability to observe trend movements as well as train decision-making skills on backtesters, because I saw that we can shorten our training to reach the master level by using the facilities and historical data provided by metaquotes. And from the software that I made, I got some important points that made my trading skills even better, at least I can apply them to the bot that I'm making.

Trendline Trade Panel MT5 : Click here

Trendline Trade Panel MT4 : Click here

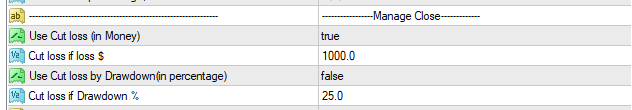

C. Account Protection

The downside to using the grid and martingale strategies is if a market crash occurs, where the price doesn't move as it should, and for that account protection is needed to prevent losing all of our deposits.

I highly recommend setting up a cutloss of 1000 for every 0.01 start lot.

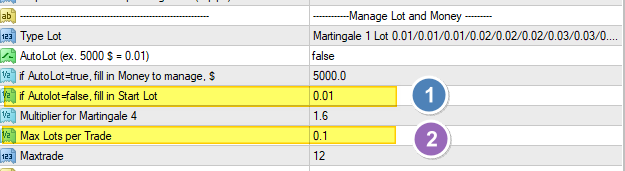

D. How To Set Up Account If Start Lot Is Not 0.01

The setfile that I provide uses the default settings for start lot 0.01.

If your start lot is not 0.01, for example 0.1, then there are 4 expert inputs that you must change:

1. Start Lot, fill with 0.1

2. Max Lot per trade, because there is an increase in lot 10 times, then multiply the standard max lot by 10, in this example the max lot per trade will be (0.1 x 10=)1.

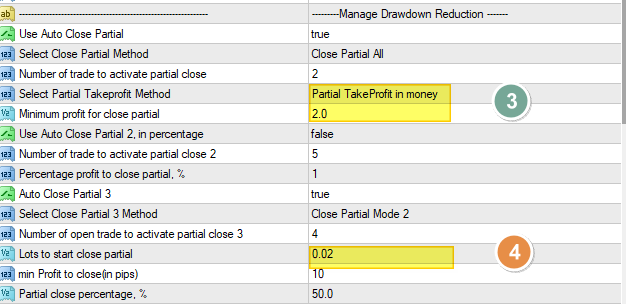

3. If the setting uses partial take profit in money, then the minimum profit for closing partial (2x10) = 20.

Note: You don't need to change it if the partial take profit uses pips.

4. Lots to start close partial (0.02 x 10)=0.2

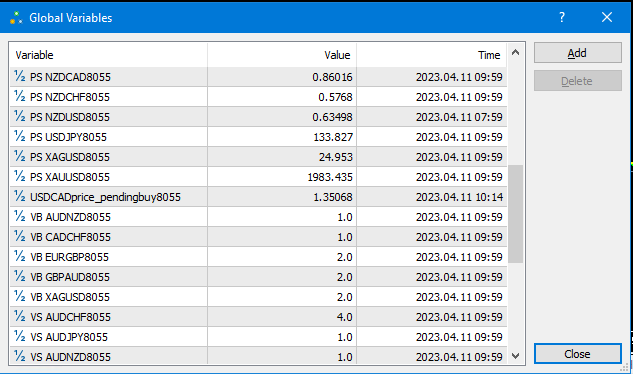

Smart Multi Symbol Control will limit the number of fx pairs that can be opened.

Default set for Maximum allowed number of fx pairs on risk =1==> conservative risk.

Maximum allowed number of fx pairs on risk=2==> moderate risk

Maximum allowed number of fx pairs on risk=3==> high risk

In the initial stages, it is highly recommended to use conservative risk, if you are starting to understand how it works you can use moderate risk or high risk.