GBP/USD: inflation in the UK has risen sharply_10/04/2017

Current dynamics

The ambiguous US macro statistics released last week, as well as the growing geopolitical tensions in the Middle East after the US missile strike in Syria, have led to an increase in volatility in the foreign exchange market.

Data on the US labor market, published last Friday, showed that the unemployment rate in March fell to 4.5%. However, the number of jobs outside the agricultural sector increased by 98,000, while economists were expecting 175,000 jobs.

The dollar declined after the publication of the data, however, was able to regain its position in the foreign exchange market after the president of the Fed-New York, William Dudley, said that the Fed will begin to reduce its balance towards the end of the year. The portfolio of assets of the Federal Reserve is 4.5 billion dollars, and such actions will lead to an increase in the value of the dollar against bond sales and the growth of their yield. Dudley believes that a reduction in the Fed's portfolio will not lead to a slowdown in the rate of interest rates. Such actions of the Fed should lead to an increase in the value of the dollar and attract investors to its purchases.

Many economists equate the reduction in the Fed's balance sheet to a tightening of monetary policy, and this, as a rule, leads to an increase in the value of the dollar.

The pair GBP / USD hit on Friday under double pressure after the publication of disappointing data on industrial production in the UK for February.

This week, market participants will follow the UK inflation data, which will be released on Tuesday (08:30 GMT). At its last meeting, the Bank of England left interest rates unchanged at 0.25%. At the same time, inflation in February reached a maximum in more than three years amid a sharp weakening of the pound (more than 20%) after the referendum for Britain's withdrawal from the EU. One member of the Monetary Policy Committee of the central bank of Great Britain voted for an immediate increase in rates. Other members also signaled the possibility of such an increase in the near future.

Nevertheless, it will be difficult for the Bank of England to take such a step because of the drop in consumer spending amid a sharp weakening of the pound. Consumer spending is one of the key elements of UK GDP.

From the news for today, we are waiting for the speech of Fed Chairman Janet Yellen, which will start at 20:10 (GMT).

Support and resistance levels

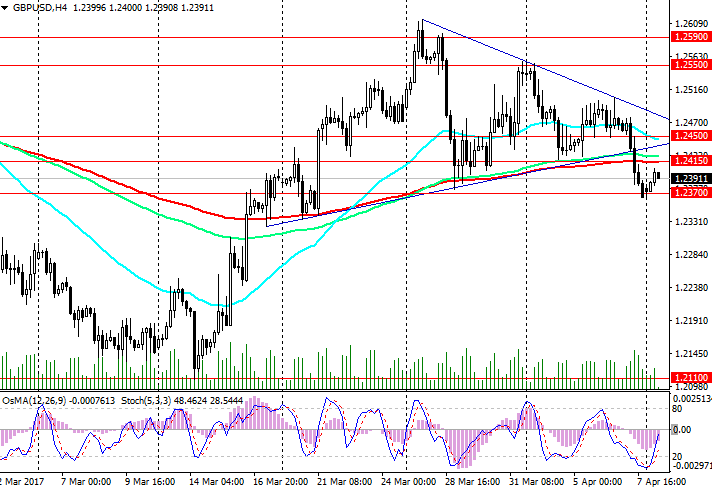

On Friday, the pair GBP / USD broke short-term support levels of 1.2450, 1.2415 (EMA200 on 1-hour and 4-hour charts).

The attempt of the upward correction, undertaken by the pair today, stalled near the resistance level 1.2400. The upward correction seems to have the end ahead of time, not reaching the level of resistance 1.2415.

The indicators OsMA and Stochastics on the daily and weekly charts are on the side of sellers. On the 1-hour chart, the indicators also unfold to short positions.

Negative dynamics of the pair GBP / USD prevails below the level of 1.2415. Only in case of consolidation above the level of 1.2450 can we return to consideration of long positions for the pair GBP / USD.

In case of breakdown at the level of 1.2490, further growth of the GBP / USD pair should be expected with the nearest targets of 1.2550 (April highs), 1.2590 (EMA144 on the daily chart). A more distant goal is the level of 1.2765.

A powerful fundamental factor in favor of short positions on the GBP / USD pair is the different orientation of monetary policies in the US and UK, the exit of the country from the European Union, the official start of which was laid in April.

Support levels: 1.2370, 1.2340, 1.2110, 1.2000

Levels of resistance: 1.2415, 1.2450, 1.2470, 1.2490, 1.2550, 1.2590, 1.2700, 1.2800

Trading Scenarios

Sell in the market. Stop-Loss 1.2415. Take-Profit 1.2370, 1.2340, 1.2150, 1.2100

Buy Stop 1.2415. Stop-Loss 1.2385. Take-Profit 1.2450, 1.2470, 1.2490, 1.2550, 1.2590, 1.2700