EUR/USD Forecast: is not about USD's strength, is about EUR's weakness

The EUR/USD pair is ending this week at its lowest in three, despite the release this Friday of a disappointing March Nonfarm Payroll report. The US economy added less jobs than expected during March, just 98,000 against the 180,000 expected, while wages' advance was in line with previous month figures. The positive note came from the unemployment rate that fell to 4.5%, its lowest in near 10 years, from a previous 4.7%.

After an initial decline, the dollar changed course and surged to fresh weekly highs against most of its major rivals, pushing the EUR/USD pair down to 1.0609. Helping the greenback was a rebound in US yields, and the fact that the employment report is not enough to change Fed's rate raise path. The common currency was also undermined by Draghi's world earlier this week, as the ECB's President stated that inflation is still too fragile to grant trimming easing.

In the meantime, US President Trump ordered a military strike on Syria overnight, Stockholm suffered a terrorist attack, and Chinese President Xi Jinping is in the US, undergoing a two day meeting with his American counterpart. Russia has announced US strike on Syria will have serious consequences on the relationship between the two countries. Risk aversion is the main motor of the financial world, and at the end of the day, the greenback is a safe-haven, regardless its latest behavior and the fact that the JPY and Gold usually outperform it in risky times.

Trading has been quite choppy ever since the week started, and unfortunately, it will probably persists over the upcoming one, amid the huge mix of political factors speculative interest needs to digest.

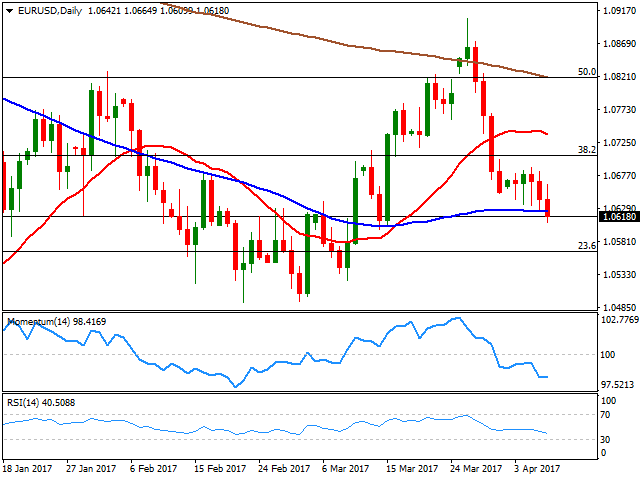

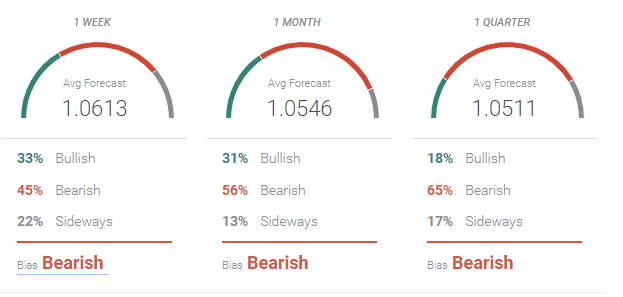

The pair is down for a second consecutive week and from a technical point of view, poised to extend is slid, given that the weekly chart shows that the price is stuck around its 20 SMA, whilst technical indicators have turned sharply lower, the Momentum still holding above its 100 level, but the RSI already at 44. Daily basis, technical readings also present a bearish bias, as the price breaks below its 100 DMA for the first time in near a month.

GBP/USD's view has remained unchanged, with the negative sentiment towards the Pound persisting amid uncertainty surrounding the Brexit. 1.2500 is seen capping advances, with a few dispersed perspectives seeing the pair above it, and by little. Nevertheless, 1.2000 seems to be a major psychological barrier towards the downside, hardly seen below it in the next three months.

For a change, bears are a majority in the USD/JPY pair, at least short term, as 60% of the polled investors see the pair falling next week, against just 37% in the previous one. Bulls, however, are a clear majority in the longer run, although the upward targets were once again revised lower, with the pair seen averaging 113.91 in three months.