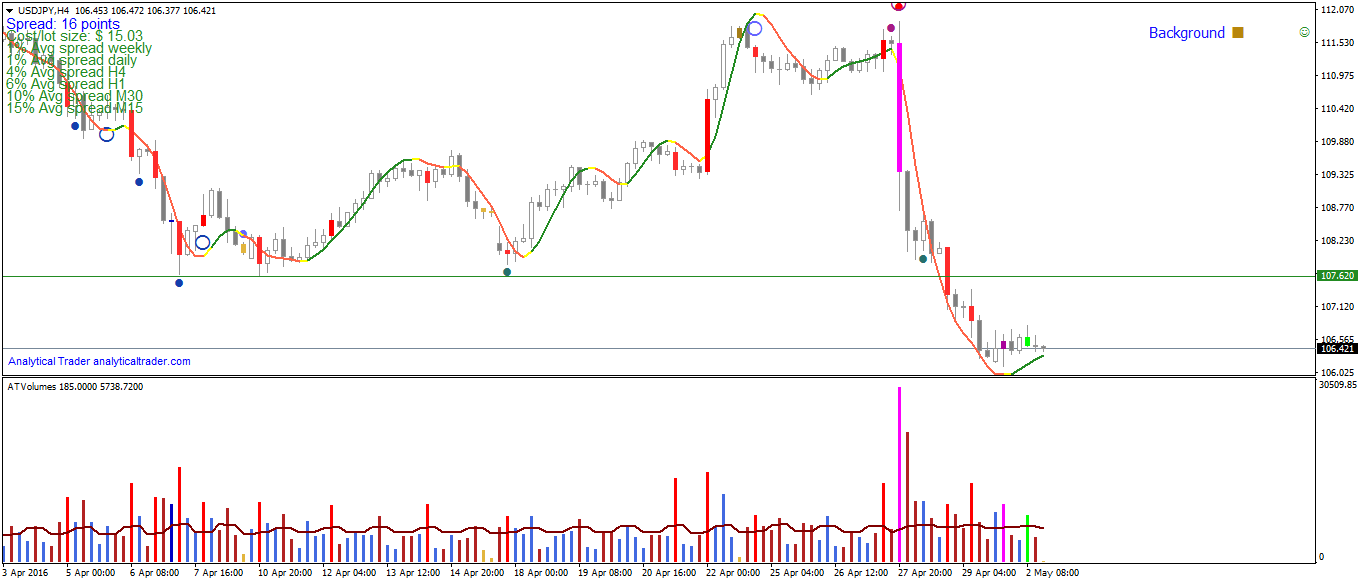

After a wide upthrust bar, also marked as heavy supply, on last Wednesday, the Yen broke the support at 107.62 the day after. It broke with healthy volume, and the prices only stopped downtrending on a reverse upthrust, and later a churn, which are volume patterns that show demand.

It would be wise to be on the lookout for more demand/strength between 106.200 – 106.300. To the upside, the price 107.62 is the trigger for short positions, if the supply shown in H4 proves to be consistent. The fact that there are many announcements regarding unemployment on US will surely provide plenty of movements, and make the price reach these critical areas in USD/JPY.