Sterling continues to march back down against the US dollar

21 January 2016, 11:51

0

75

Sterling was able to score against the US dollar since the beginning of the year until today's losses reached -4.01% due to first restore the US dollar index upward trend since the beginning of the year and, secondly, the British retreat from the Bank to raise interest rates soon. Had Mark Carney Governor of the Bank of England statement this week, he declared that if the current time is not appropriate to raise interest rates, and that there is no specific timing for raising interest rates, for the Bank of England to make sure and keep the economy by pursuing economic data. The target rate of inflation at the 2% level remains with the knowledge that to reach this goal is not the coast because of the deterioration of oil prices. So far the pound remains under the pressure of the current economic conditions, prompting the Bank of England at the beginning of this month to install interest rates at 0.5% and quantitative easing program at 375 billion pounds.

Traders current positions on GBP / USD

British pound against the US dollar - the percentage of long positions on GBP / USD about 70%, traders yesterday entered into a purchase centers, and was open purchase centers for traders 72%. Declined 3.9% purchase centers than yesterday and 3.0% above the levels of last week. Short positions rose 4.9% than yesterday and 1.4% below the levels of last week. The total open positions for traders stood at 1.5% lower than yesterday and 8.9% above the monthly average. We use reverse speculator confidence index as an indicator, and the fact that the majority of traders are buyers that refers to the possibility of the low price. Market sentiment has become less optimistic compared to yesterday but still more optimistic than last week. Price trends in the recent market sentiment give uncertain prospects.

Today's strategy on the currency pair sterling against the US dollar

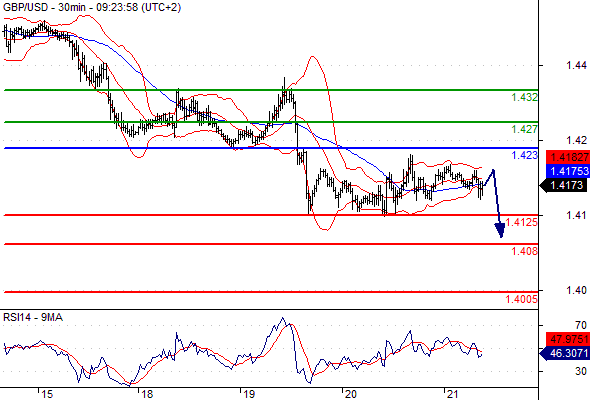

Selling below the level of US $ 1,423 with a primary objective at 1.4125 centers and 1,408 line as a target Next.

Pivot Point: 1,423 USD

Baseline scenario: Sell below the level of US $ 1,423 centers with a primary objective at 1.4125 and 1,408 line as a target Next.

The opposite scenario: above the level of US $ 1,423, you can search for increasingly high with 1,427 and 1,432 basic line as targets.

Comments: as long as 1.423 line is the line of resistance, there is a continuation of the bearish bias.

Diagram 30 minutes for the pair sterling against the US dollar

Disclaimer: Past performance is not indicative of future results.

Please note that the information contained on this site is for retail customers only, and is not eligible for any of the participants (ie institutional clients) as defined in the Commodity Exchange Act §1 (a) (18).

Support and resistance lines

Pair: GBP / USD

3 support line : 1.4005

2 line support: 1.4080

Support 1 line: 1.4125

Current price 1.4174

Line resistance 1 :1.4230

Line resistance 2 :1.4270

Line resistance 3: 1.4320