An upturn in inventories and higher exports helped Japan log stronger-than expected growth in the first three months of 2015, but those drivers may cool in the second quarter, says the Wall Street Journal.

Real GDP expanded 2.4% on an annualized basis or 0.6% quarter-on-quarter. Private-sector inventory investment contributed 0.5 percentage point of that. Thus, growth would have been close to zero if inventories hadn’t risen.

As economists at Barclays commented, it is difficult to view in a positive light, as this reflects production in excess of final demand.

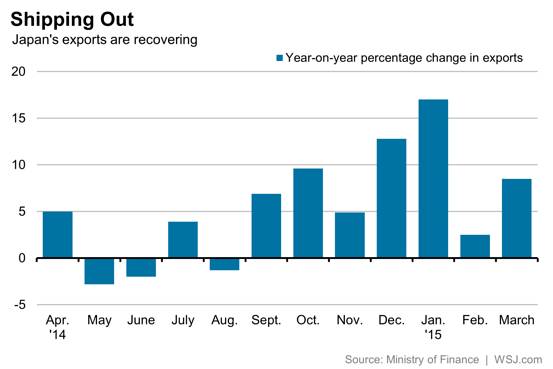

Exports were up 2.4% quarter-on-quarter, following a 3.2% rise in the October-December quarter, being another bright spot. The cheaper local currency is finally beginning to influence Japan’s trade and companies like Fuji Heavy Industries Ltd., maker of Subaru cars, are racking up record sales with help from products made in Japan and shipped to the U.S.

If the U.S. and China - the world’s two biggest economies and Japan’s two biggest customers - will keep supporting Japan’s recovery is a question now. Recent downbeat economic data have led to fresh expectations of a more lacklustre U.S. growth. And property is a drag on China’s economy.

Japan’s economy has been swinging in the recent years: 2014’s increase in the national sales tax led to a big step back, while Wednesday’s GDP growth was a step ahead for Prime Minister Shinzo Abe’s stimulus program. In order to announce a complete return to health, Mr. Abe needs more than two quarters of pickup, and that will need a help from global trading partners which are themselves operating at less than full strength.