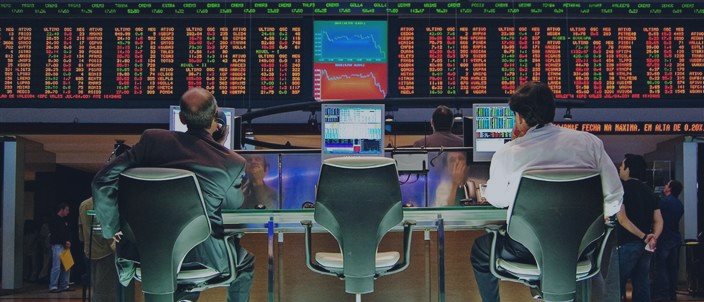

Emerging-market stocks fall on rout in Chinese equities; Russian and Nigerian shares rise

A regulatory crackdown on high-risk margin trading led to the biggest rout in Chinese equities since 2008. This, in turn, sent emerging-market stocks lower on Monday.

The MSCI Emerging Markets Index declined 0.3 percent to

955.09 at 12:02 p.m. in London, its second day of losses. The

gauge is little changed since the start of the year as a plunge

in Brent crude outweighed a bigger-than-forecast increase in

Chinese exports. While oil trades 13 percent lower this year, it

rose last week, its first gain since November.

The Shanghai Composite Index, which had rallied 67 percent

in the 12 months through last week, plunged 7.7 percent today.

That was the biggest retreat since June 2008 and pushed the 30-day volatility on the measure to the highest level in five

years. The Hang Seng China Enterprises Index of mainland stocks

traded in Hong Kong plunged 5 percent, the most since November

2011.

The yuan weakened 0.2 percent versus the dollar.

Citic Securities Co. and Haitong Securities Co., China’s two biggest listed brokerages, dropped by the 10 percent daily limit in Shanghai after they were suspended from lending money to new clients. A gauge of information-technology companies headed for the highest close since November after India’s Wipro Ltd. reported better-than-estimated quarterly profit. The ruble strengthened after oil traded near $50 a barrel and Standard & Poor’s delayed a decision on whether to cut Russia’s sovereign rating to junk.

As Bloomberg reports, Chinese regulators moved to cool down the world’s best-performing stock market by tightening norms for trading with borrowed money. Their action came after outstanding margin loans in the country almost trebled to $174 billion since June and bank lending to companies for investing in financial markets surged to the highest on record.

“A tighter grip on margin lending is having a big impact

on the market,” Maarten-Jan Bakkum, an emerging-market

strategist at ING Groep NV in The Hague, said by e-mail.

“It shows once again how much the Chinese market has been driven by liquidity and technicals. Risk remains high there. The rest of the emerging world is not really affected by this.”

Russian and Nigerian shares climbed

amid optimism oil prices will stabilize.

The benchmark Micex Index advanced for a fifth day in Moscow, led by OAO Gazprom and OAO Lukoil. The gauge gained 2 percent to the highest level since March 2012. Brent slid 0.5 percent after earlier rising to as high as $50.35 a barrel. The ruble jumped 1.3 percent to 64.338 a dollar.

Nigeria’s benchmark index surged 2.5 percent, its biggest gain since Christmas. Thai shares advanced 1.2 percent, led by a 9.7 percent rally in Bank of Ayudhya Pcl.