S&P 500 TECHNICAL ANALYSIS – Prices extended

upward after clearing resistance in the 1985.30-91.40 area marked by

the 50% Fibonacci expansion and the July 24 high, with the bulls

targeting the intersection of a formerly broken channel floor and the

61.8% level at 2006.80. A further push beyond that aims for the outer

boundary of the index’s long-term uptrend at 2025.80. Alternatively, a

turn back below 1985.30 targets the 38.2% Fib at 1963.70.

GOLD TECHNICAL ANALYSIS – Prices are once again testing above resistance at 1282.47, the 61.8% Fibonacci expansion. A break above this barrier on a daily closing basis exposes the 50% level at 1290.15. Alternatively, a reversal below the 76.4% Fib at 1272.98 targets a falling channel floor at 1266.11, followed by the 100% level at 1257.63.

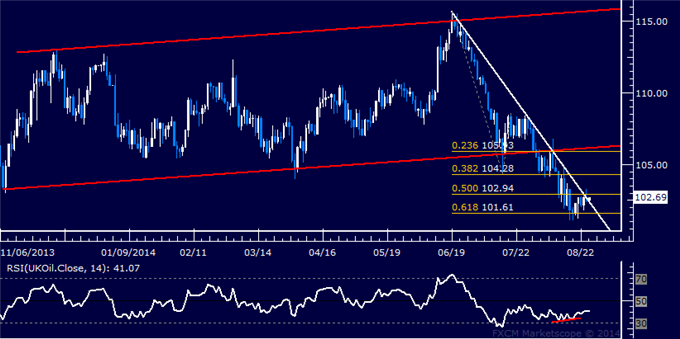

CRUDE OIL TECHNICAL ANALYSIS – Prices are attempting to inch higher as expected after showing positive RSI divergence on a test of support at 101.61, the 61.8% Fibonacci expansion.A

daily close above 102.94, the intersection of the 50% level and a

falling trend line set from mid-June, targets the 38.2% Fib at 104.28.

Alternatively, a break below 101.61 exposes the 76.4% expansion at

99.96.