How to Spot High Probability Entry Points in Forex Trading

How to Spot High Probability Entry Points in Forex Trading

One of the most important things you can do as a forex trader is to identify high-probability entry points.

This will help you to get in on good trades and increase your chances of profitability.

In this article, we will discuss some of the things you can look for to identify high-probability entry points.

-Introducing forex trading and the different types of entry points

Forex trading is a popular way to invest money, and it can be profitable if you understand how it works.

The first step is to learn about the different types of entry points and what they mean for your trading strategy.

There are four main types of entry points in forex trading: market order, limit order, stop order and trailing stop order.

Each one has a specific purpose, and you need to understand when and how to use them if you want to be successful in forex trading.

Market orders are the simplest type of order. When you place a market order, you are asked to buy or sell at the best available price.

This is the most common type of order, and it is used when you want to get into a trade as quickly as possible.

Limit orders are used when you want to set a specific price point for your trade. With a limit order, you are asking to buy or sell at a price that is better than the current market price.

This type of order is used when you want to get into a trade, but are not willing to pay the current market price.

Stop orders are used to protect your profits or limit your losses. When you place a stop order, you are asked to buy or sell at a price that is better than the current market price, but only if the stock hits a certain price.

This type of order is used to protect your profits or limit your losses.

Trailing stop orders are similar to stop orders, but they are more flexible.

With a trailing stop order, you are asking to buy or sell at a price that is better than the current market price, but only if the stock hits a certain price

-How to determine the best entry points for your trading strategy

https://www.mql5.com/en/market/product/47776

There are a few factors you need to take into account when choosing where to enter a trade.

Firstly, you need to consider the market conditions.

Are the markets trending or are they range-bound?

Secondly, you need to look at the price action. I

s the market in a consolidation phase or is it in a full-blown trend?

Thirdly, you need to take into account your own trading style.

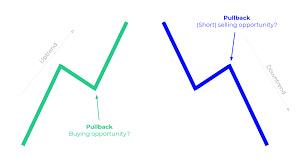

Do you prefer to trade breakouts or pullbacks?

Once you have determined the market conditions, price action and your trading style, you can then start to look for specific entry points.

There are a few different types of entry points that you can use: trendlines, Fibonacci levels, candlestick patterns and pivot points. Let's take a look at each of them in more detail.

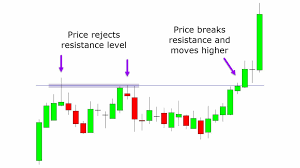

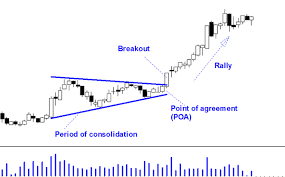

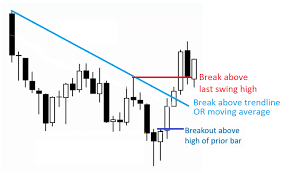

Trendlines are one of the most popular entry points used by traders. A trendline is simply a line that is drawn between two or more points of price data on a chart.

When the market breaks above a trendline, it is considered to be a bullish signal, and when the market breaks below a trendline, it is considered to be a bearish signal.

Fibonacci levels are another popular entry point used by traders. Fibonacci levels are drawn between two points of price data and are used to identify potential support and resistance levels.

When the market breaks above a Fibonacci level, it is considered to be a bullish signal, and when the market breaks below a Fibonacci level, it is considered to be a bearish signal.

Candlestick patterns are also a popular entry point for traders. There are many different candlestick patterns that you

-Spotting high probability entry points in real time

There are countless technical indicators and strategies that traders can use to spot high probability entry points in the markets.

However, in order to be successful, it is essential to use a process that is systematic and easy to follow.

One approach that can be used to find high probability entries is to look for price patterns.

Price patterns are formations that are created by the interaction of buyers and sellers in the market and can often provide insights into future price movements.

There are a number of different price patterns that traders can look for, but some of the most popular include head and shoulders, double tops and bottoms, and triangles.

These patterns can be used to identify potential entry points in the market, and can be very profitable when traded correctly.

Another approach that can be used to find high probability entries is to use technical indicators.

Technical indicators are mathematical formulas that are used to measure the price and volume of a security.

Many technical indicators can be used to identify overbought and oversold conditions, which can be used to find high probability entry points.

Lastly, traders can use fundamental analysis to find high probability entry points.

Fundamental analysis is the study of a company's financial statements and other publicly available information in order to assess its intrinsic value.

By doing this, traders can identify stocks that are trading at a discount to their intrinsic value and may be good candidates for a long position.

Whichever approach that traders decide to use, it is important to remember to always use a stop loss order to protect their capital.

By using a systematic process and following a well-defined plan, traders can increase their chances of finding high probability entries in the markets.

-Tips for maximizing your profits from forex trading

There are a number of things you can do to help maximize your profits from forex trading.

One of the most important is to use a good trading system that gives you accurate signals.

Additionally, you should also make sure you are well-informed about the market conditions and news that could impact your trades.

You should also use a broker that offers good spreads and low commissions. Finally, make sure to practice good risk management and have a solid trading plan.