In this article we will try to closely look at the well-known indicator of Bill Williams Awesome Oscillator (AO). Initially, it should be noted that not only AO is well-known itself but also the fact that it is almost identical to the indicator MACD of Gerald Appel. Experts often claim that AO does not give anything new in comparison with the classic MACD. Is it so? Let's investigate.

When they talk about the differences between AO and MACD, the price used for calculations is pointed first of all. In comparison with MACD, AO does not use the closing price Close, but uses median price Median = (High + Low) / 2. Indeed, at first glance, the difference is very inessential. However, this view may be misleading. It is possible that here we are faced with a case of witch Harvey Mackay said: "Small things do not play a decisive role. They are everything."

To find out the truth, let’s investigate the nature of prices. According to the Elliott wave principle, price fluctuations can be represented as a set of waves of different scales when the slow waves are superimposed by more fleeting ones, and those, in turn, even more fleeting, and so on. Consider the model of price fluctuations according to the wave concept. For simplicity, we assume here that the oscillations are sinusoidal and imagine that the price dynamics consists of only two such oscillations – one slow and one fast. Let the initial timeframe will be M5.

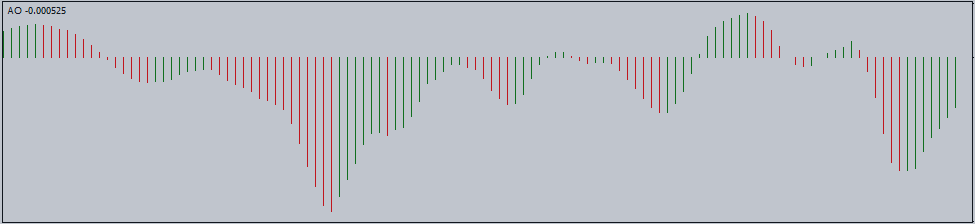

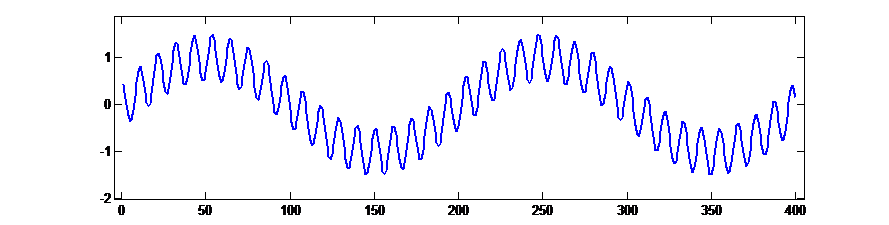

Slow waves (timeframe М5):

Fig. 1. Slow waves

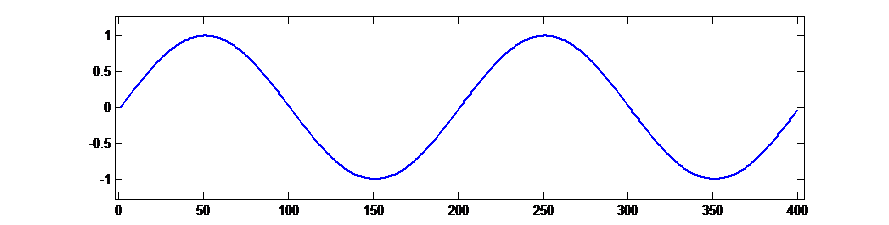

Overlay slow waves of fast waves (timeframe М5):

Fig. 2. Fast waves

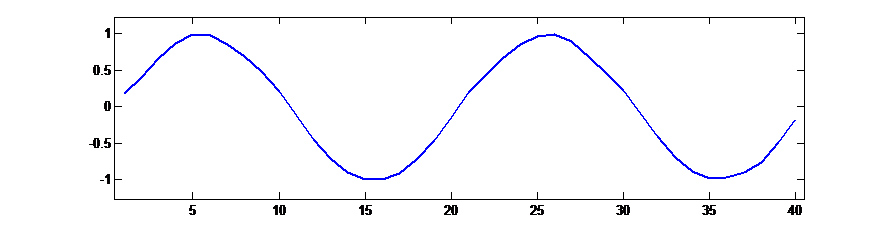

Median price on timeframe H1:

Fig. 3. Median price

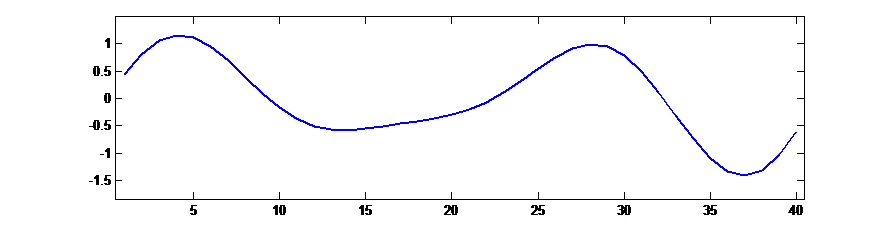

Close price on timeframe H1:

Fig. 4. Close price

Now let's see how the price will look on timeframe H1. We consider two cases: Median price and Close price.

What do we have as a result? By Median price on timeframe H1 we see initial slow waves, almost not distorted. At the same time the price Close on timeframe H1 shows significant distortion of the original price dynamics. If someone will carry out an analysis with such Close price, build forecasts, the results will be wrong, and the trade will be unprofitable. The observed distortion is explained by the aliasing effect known in a digital signal processing.

We come to the conclusion that the indicator AO that uses Median price shows the dynamics of price changes more adequately than the MACD indicator that uses price Close. So Median price can be fully trusted, and the Close price cannot be trusted surprisingly.

So, in this part of the article we looked at one aspect of the AO indicator. The next part will be considered to AO physical meaning.